Chainlink Monthly Finish Flashes Grand Finale Sell Signals

Chainlink has been the biggest success story in the crypto market since the 2017 bubble popped. In 2020 alone, the asset is up over 700%. From low to high the asset surged over 1200%, helping to grow the altcoin’s market cap to nearly as large as the Ripple and Tether.

But after such a sizable rally, it could be a situation of the bigger they are, the harder they fall, now that LINKUSD has triggered two sell signals on monthly timeframes.

All About The TD Sequential Indicator And What It Means For The Chainlink Rally

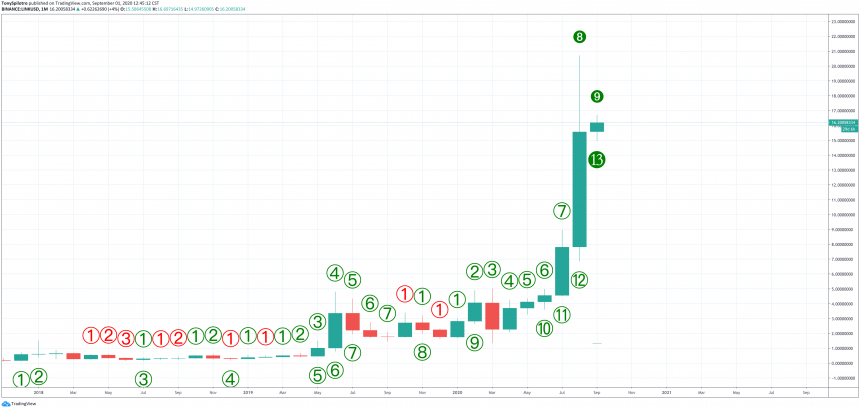

With last night’s August 2020 close, a new monthly candle began. The TD Sequential indicator counts each new candle as another step in a sequence. When a series of candle closes follows a specific sequence, the indicator will provide a setup signal.

If the sequence fails to complete and reach a 9 count, the series will begin again. A 9 count is just one type of sell setup along with a 13-candle countdown.

When these signals appear, it signals trend exhaustion and that a reversal could soon follow. The tool has been used throughout crypto and the broader financial market to accurately time tops and bottoms.

Related Reading | Mega Bitfinex Bitcoin Whale: Chainlink FOMO Will Eventually Fizzle

More weight is given to each signal depending on how high of a timeframe the signal is found on. For example, a TD 9 sell on a 4-hour chart, isn’t nearly as impactful as a sell signal on the daily or weekly.

Chainlink, the once-unstoppable cryptocurrency, just triggered not one but two of these ominous signals on one of the highest timeframes possible: the monthly.

LINKUSD Monthly TD Sequential 9 & 13 Sell Setup | Source: TradingView

TD 9 Sell Setup Triggers On LINKUSD One-Month Price Charts

The new September monthly candle open in LINKUSD, immediately triggered a 9 and 13 sell setup on the TD Sequential indicator. The tool has near-perfectly called almost every major Bitcoin top and bottom.

Because the signal is appearing on the way up at what could be the peak of a parabolic climb, the signal hints at downside, not continuation. Whether or not a complete reversal is in the cards remains to be seen.

Related Reading | Smart Money Indicator Signals Bitter End To Chainlink Uptrend

But after such a substantial rise over such a short period, it is not uncommon for assets – especially cryptocurrencies – to over-correct. Take Bitcoin for example. After Bitcoin touched $ 20,000, it crashed by over 80% according to the laws of parabola.

Analysts like Peter Brandt called for the collapse based on past statistics alone from when other parabolic assets retrace. There’s no denying Chainlink went fully parabolic and into price discovery mode.

During that phase, it discovered that near $ 20 was the top, and now its time to discover where the bottom may be, according to the TD Sequential indicator.