Bitcoin Price Struggles: Crypto Analyst Bucks Back Against Bearish Sentiment, Top Is Not In

Amid the Bitcoin price struggles, crypto analyst BitQuant has pushed back against the idea that the top is in and instead provided a bullish outlook for the flagship crypto. He also remarked that he would reveal when the “real top” is in.

Analyst Affirms Top Isn’t In Yet Despite The Bitcoin Price Stuggles

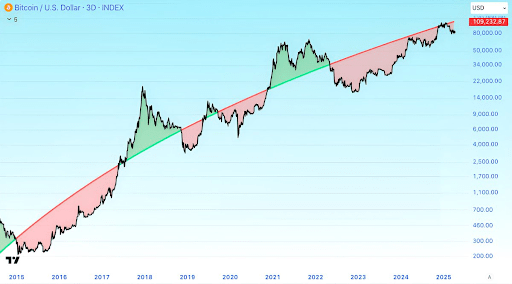

In an X post, BitQuant was confident as he assured that the top isn’t in yet despite the Bitcoin price struggles. He noted that during the last cycle, market participants argued that $ 60,000 didn’t look like a top, even though it had a perfect textbook structure of one. Now, there is a panic although this top structure has yet to form in this market cycle.

The analyst stated that he understands the bearish sentiment but that this is likely because some market participants haven’t experienced the bull phase yet. He affirmed that when the real top is in for the Bitcoin price, and there is a 25% pullback, he will post his accompanying chart again. The analyst added that market participants would know for sure, without any guidance, whether the top is in or not.

Crypto analyst Kevin Capital also suggested that the top isn’t in yet for the Bitcoin price. However, he admitted that the crypto is in a major correctional phase in the market. The analyst remarked that these corrections take time and asked market participants to stay patient while monitoring the macro data and monetary policy updates.

Kevin Capital mentioned that much can be done in the meantime and claimed that this is what crypto is like. He added that most of the Bitcoin price gains are accomplished in a two-week period every year. Other times, the flagship crypto simply trades sideways or witnesses significant declines.

BTC Still Risks Dropping To As Low As $ 70,000

In a recent analysis, Kevin Capital predicted that the Bitcoin price could still drop to as low as $ 70,000. He stated that if BTC loses the golden pocket at $ 81,000 and follows through with that measured target, then the $ 70,000 to $ 73,000 range, which he has outlined on the higher time frames, would be the “Measured Move” target.

The analyst also remarked that there are lots of factors this week that will influence price action. One is Donald Trump’s tariff implementation on April 2nd, which he suggested could be a buy-the-news event in the sense that BTC has also priced into the effects of the proposed tariff and could surge once the event occurs.

Kevin Capital also highlighted other macro factors, such as the labor market data at the end of the week. Meanwhile, the US Treasury run-off will decrease from $ 25 billion to $ 5 billion starting April 1st. The analyst admitted that it remains uncertain whether these events have an immediate sentiment effect or even affect the sentiment at all.

At the time of writing, the Bitcoin price is trading at around $ 82,000, down almost 2% in the last 24 hours, according to data from CoinMarketCap.