The Bitcoin network surpassed 926,000 daily transactions, driven by a growing interest in Runes.

support has been a member since October 4th 2014, and has created 2782 posts from scratch.

This Author's Website is http://cryptopools.com

The Bitcoin network surpassed 926,000 daily transactions, driven by a growing interest in Runes.

Bitcoin and altcoins continue to be rocked by macroeconomic and geopolitical uncertainty, but data shows bulls continue to buy each dip.

Two Solana-based memecoins, Bonk (BONK) and Dogwifhat (WIF), have registered substantial gains over the past 24 hours. BONK recorded a 35% increase, while WIF climbed by 19%, positioning them among the top three gainers in the top 100 cryptocurrencies by market cap today. Only Hedera Hashgraph (HBAR) surpassed them, with a notable 44% rise during the same period.

The significant uptick in these Solana memecoins is closely linked to the recent improvements in the Solana network’s performance. A tweet from SolanaFloor earlier today indicated, “BREAKING: Solana’s congestion issues have been completely resolved, with block production back to normal. Transactions confirming in under 2 seconds.” This announcement marks a pivotal moment for the network which had been plagued by congestion issues.

Source A: https://t.co/2TVnbaPNlHSource B: https://t.co/GfHxy8dC1B

— SolanaFloor | Powered by Step Finance (@SolanaFloor) April 24, 2024

On April 15, Solana developers rolled out crucial updates designed to alleviate these problems, urging validators to adopt version v1.17.31. This version introduces changes in the treatment of validators based on their stakes. Further enhancements are anticipated with the release of version v1.18 next month, which will include a new scheduler, albeit disabled by default.

Andrew Kang, founder of Mechanism Capital, remarked a few days before the fix, “Let’s also not forget that the Solana congestion issues have weighed down SOL and Solana-based memecoins significantly. It’s not a question of if but when the network is significantly improved. That’s your springboard.” Kang’s comments now seem prophetic as the resolution of network issues has indeed acted as a springboard for memecoin valuations.

Specifics On Rally Of Dogwifhat (WIF) And BONK

The price of WIF soared to a 24-hour high of $ 3.43 on April 24, buoyed by an impressive 96% increase in trading volume. This influx was fueled by notable acquisitions from whales like Ansem, who capitalized on the positive market sentiments.

The breakout above the resistance level at $ 3.18, after a week of sideways trading between $ 1.97 and $ 3.18, was a significant trigger. WIF formed a two-week-long ascending triangle, a bullish chart pattern that indicated a continuation of the previous upward trend. The breakout was widely discussed in the crypto community, with trader Bluntz Capital confirming the pattern’s resolution and sparking further bullish sentiment.

2 week long ascending triangle forming here on $ WIF, i think the breakout is imminent pic.twitter.com/S0OZWBsq6u

— Bluntz (@Bluntz_Capital) April 24, 2024

BONK is registering a dramatic 35% rise, with a remarkable 304% increase in trading volume. The price action successfully breached the 0.236 Fibonacci retracement level at $ 0.000020727, and continued its upward trajectory to the 0.5 Fibonacci level, signaling strong buying interest and bullish momentum.

This rally probably gained additional support from the recent listing of BONK by the global neobank Revolut, which was announced on April 22. This inclusion in Revolut’s trading platform, which features over 150 digital currencies, provided significant exposure and legitimacy, further enhancing investor interest and market activity around BONK.

The legal battle between Ripple and the Securities and Exchange Commission (SEC) is getting heated and, following recent developments, looks far from over. This is due to the disagreement between both parties on the appropriate remedy for Ripple’s violation of securities laws.

In opposition to the SEC’s motion for remedies and entry of final judgment, Ripple has proposed that the court should not impose a civil penalty of not more than $ 10 million. This figure represents a far cry from the SEC’s proposed judgment. The Commission had earlier asked the court to order Ripple to pay the sum of $ 1,950,768,364 as a pecuniary fine for violations relating to its institutional XRP sales.

Specifically, the SEC proposed that Ripple pay a civil penalty of $ 876,308,712 alongside a prejudgment interest of $ 198,150,940 and disgorgement of $ 876,308,712, which represents the profits from its violation of the Securities Act. However, Ripple asked the court to deny the requests for disgorgement and pre-judgment interest and only focus on the civil penalty, which shouldn’t be more than $ 10 million.

Ripple’s lawyers also laid out arguments as to why the civil penalty should not exceed $ 10 million. Firstly, they stated that the first tier of the statutory maximum penalties is what applies to this case “because the SEC has never alleged fraud, deceit, or manipulation and has failed in its belated attempt to show that Ripple recklessly disregarded the law.”

Therefore, Ripple argued that the Commission’s request for a civil penalty of over $ 876 million isn’t the appropriate remedy for the first-tier structure. They added that the company’s revenue from pre-complaint institutional sales should be the only earnings considered when deciding on a remedy, which makes a civil penalty of not more than $ 10 million more appropriate.

Ripple suggested that the SEC made an error in calculating the company’s earnings while deciding on the right amount for which the crypto firm should be fined. According to the company’s lawyers, the Commission failed to “analyze or even consider any other categories of Ripple’s expenses.”

Meanwhile, they allege that the SEC didn’t offer any evidence or explanation “for why cost if revenue is the only category of Ripple’s deductible expenses.” Simply put, Ripple argues that the regulator, while calculating Ripple’s earnings, didn’t consider how much the company expended before deciding that almost $ 2 billion was an appropriate fine.

Ripple’s lawyers made this argument while stating that the SEC also erred in relying on the declaration of Andrea Fox, an accountant at the agency. They claim that the SEC never disclosed Fox as a fact or expert witness and that she wasn’t deposed during the initial discovery or supplemental remedies discovery. Therefore, they moved to strike her declaration as an “untimely disclosed expert report.”

Ripple Also Opposes SEC’s Proposed Injunction

As part of its entry for final judgment, the SEC had asked the court to “permanently” restrain and enjoin Ripple from “directly or indirectly conducting an unregistered offering of Institutional Sales.” Understanding how this could affect their ODL transactions, Ripple has asked the court to deny the request for an injunction.

The crypto firm argues that the Commission has failed to show why an injunction is warranted. Injunctions are usually granted when there is a fear of future violations. Ripple claims that the SEC has failed to show a “reasonable likelihood of future violations.”

The crypto firm’s lawyers further revealed that Ripple has “changed the way it sells XRP and changed its contracts to avoid any future violations.” To show good faith, they submitted a declaration by Ripple’s President, Monica Long, which describes the steps the company has taken to avoid future violations.

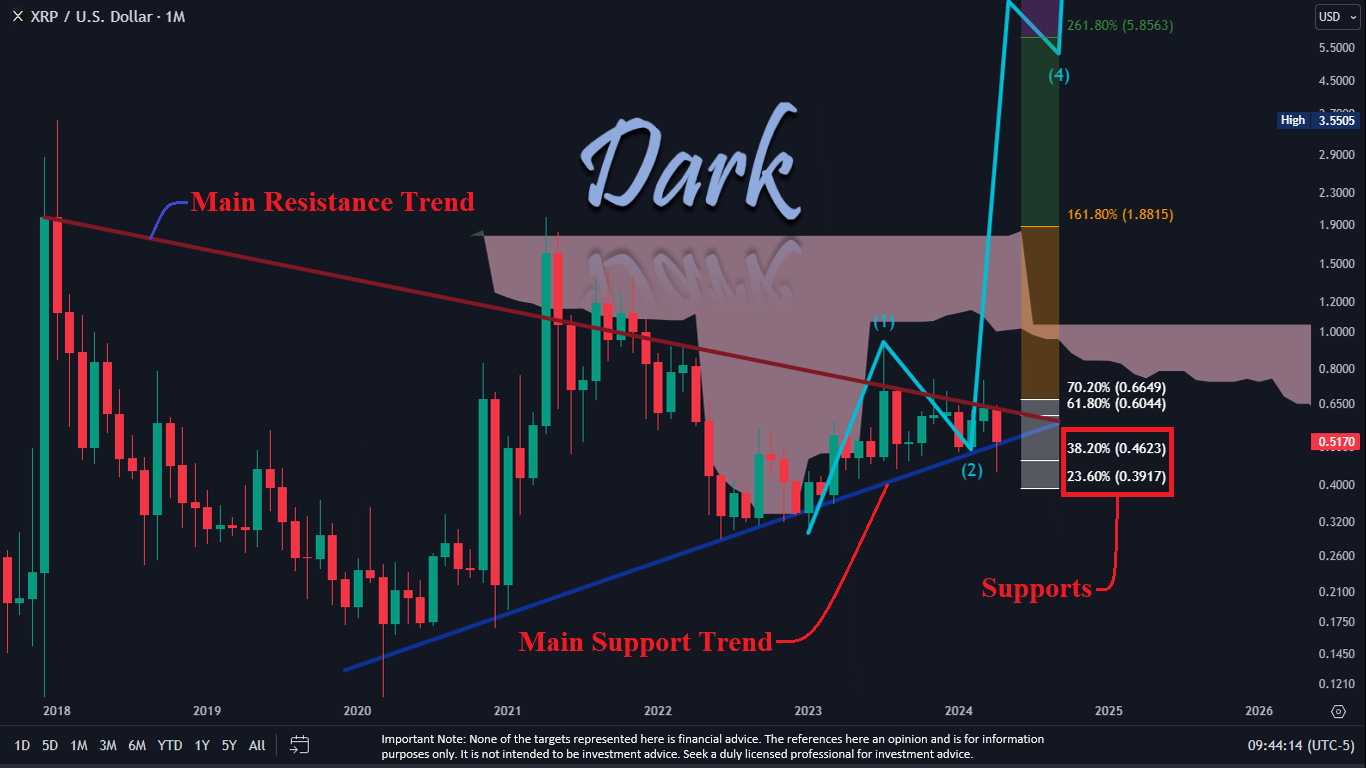

In a chart analysis shared via X, the crypto analyst Dark Defender provided insight into the potential price movements of XRP ahead of this week’s Ripple-SEC case update. The analysis, conducted on a monthly time frame, reveals that XRP has been holding above a critical support trend marked in blue. With the crypto community’s eyes set on the new Ripple filings expected next week, there’s a mix of anticipation and caution.

Dark Defender notes that although market news does not typically have a direct correlation with price movements, the “last puzzle piece” pertaining to the Ripple case may add a layer of enthusiasm to the market sentiment surrounding XRP. The question posed is: What could happen if XRP fails to maintain its position above the blue support line?

According to the analysis, if XRP breaks below this blue support line, it will likely approach the two critical Fibonacci retracement levels at $ 0.4623 (38.2% retracement level) and $ 0.3917 (23.6% retracement level). These figures are derived from the swing high and low points on the chart, traditionally considered potential support levels where the price could stabilize or bounce back.

In the context of the current chart, a drop below these levels, particularly if the price closes under $ 0.3917 for two to three days consecutively, would invalidate the bullish five-wave structure that Dark Defender suggests could propel XRP to a high of $ 5.85. On the flip side, should XRP reclaim the 61.8% Fibonacci level at $ 0.6044, it could signify a first step towards a strong upward move.

Between the price range of $ 0.6649 and $ 0.3917, any price movement is considered a sideways trend. A breakout above the 70.2% level at $ 0.6649 would likely confirm a bullish trend, with the analyst highlighting this as a significant threshold for a positive price trajectory. Above this level, XRP would then eye the next Fibonacci extension levels of $ 1.8815 (161.8% extension) and potentially $ 5.8563 (261.8% extension), which are ambitiously projected targets.

The chart also highlights a “Main Resistance Trend” line that has capped the price since the peak of early 2018, and the current price action is pinched between this descending resistance and the ascending support trend lines, forming a converging pattern that traders often interpret as a potential breakout signal.

A breakout could be the first bullish indication of a larger rally, with at least one monthly close above the line required. In the past, several attempts at a breakout have failed, and even one monthly close was followed by a fall back below the trendline the following month.

Ripple Labs is gearing up to file its response to the US Securities and Exchange Commission’s (SEC) remedies briefing on April 22, a pivotal moment in their protracted legal battle. This response from Ripple is in reaction to the SEC’s briefing that put forth potential remedies including disgorgement of profits derived from XRP sales and civil penalties. The financial stakes are high, with the SEC calculating fines that could reach around $ 2 billion, claiming that Ripple engaged in an unregistered securities offering with its XRP sales.

The legal and financial communities expect Ripple to mount a formidable defense against the SEC’s claims. Key to this counter-argument will be undermining the SEC’s assertion of the necessity for disgorgement, given the alleged lack of demonstrable financial harm to XRP purchasers. Furthermore, Ripple is likely to leverage favorable recent legal decisions and regulatory developments, aiming to weaken the SEC’s position.

According to the schedule, Ripple is expected to submit a public redacted version of its opposition brief along with associated declarations and exhibits today, if these materials are devoid of any SEC-designated confidential information. If confidentiality is a concern, Ripple will file the documents under seal and submit a redacted public version by April 24. Following this, the SEC will have the opportunity to reply, with their response anticipated to be filed under seal by May 6.

At press time, XRP traded at $ 0.53.