Price analysis 2/13: SPX, DXY, BTC, ETH, BNB, XRP, DOGE, ADA, MATIC, SOL

Bitcoin and major altcoins look vulnerable to a deeper correction after the crackdown on Paxos soured sentiment across the crypto market.

Kraken’s staking down, FTX post-bankruptcy hell and Binance news: Hodler’s Digest, Feb. 5-11

Top Stories This Week Kraken reaches $ 30M settlement with SEC over staking as IRS seeks user information Kraken has agreed to stop offering staking services or programs to United States clients after reaching an agreement with the U.S. Securities and Exchange Commission (SEC). Along with ceasing operations, the crypto exchange will pay $ 30 million in […]

Price analysis 2/10: BTC, ETH, BNB, XRP, ADA, DOGE, MATIC, DOT, LTC, AVAX

The SEC’s crackdown on Kraken has sent a shockwave through the crypto sector. Is this week’s correction a buy the dip opportunity or a sign of worse things to come?

Why are artificial intelligence tokens going parabolic? Watch Market Talks live

Join us as we discuss the reasons behind the recent price rally of artificial intelligence tokens.

Bearish Signal? DCG Starts Selling Grayscale Crypto Shares At Almost 50% Discount

The issues at Digital Currency Group (DCG) seem to be coming to a head as the company has now begun offloading its Grayscale crypto shares. This move is one that was under speculation for a long time in the crypto community, as well as what kind of impact such a move could have on the market.

DCG Selling Grayscale Shares For Large Discount

Following Genesis Trading’s filing for bankruptcy last month, it was brought to light that the platform owed significant amounts of money to creditors. One of those creditors is the Gemini crypto exchange whose Earn customers are reportedly owed around $ 900 million. This obviously triggered liquidity issues for DCG, its parent company, which is now selling off Grayscale shares in an effort to keep afloat.

On Tuesday, Financial Times reported that DCG had filed a document with the US Securities and Exchange Commission which showed that the company was selling a significant portion of its holdings in Grayscale, another company that operates under the DCG umbrella.

According to the filing, DCG has now sold about a quarter of its holdings in the Grayscale Ethereum fund (ETHE). The company also sold off shares from various Grayscale crypto funds. These include the Litecoin fund, and the Ethereum Classic Fund, among others.

Interestingly, the company reportedly sold the shares for around 50% of what they are actually worth. The ETH fund shares were sold for approximately $ 8 each when their value compared to Ether is actually over $ 16.

DCG CEO Barry Silbert defended the sale of the shares saying that they were “simply part of our ongoing portfolio rebalancing.” The sale is the company’s first sale in over a year since it last sold some of its Ether fund shares back in 2021.

Will DCG’s Dump Affect The Crypto Market?

So far, DCG’s sale of its Grayscale shares has not had any impact on the movement of the broader crypto market. This could be because the company seems to be avoiding selling off any of its Grayscale Bitcoin Trust (GBTC) shares.

The GBTC is the largest Bitcoin trust in the world and with over $ 14 billion under management, the trust accounts for around 3% of the total BTC supply. As of January 2023, DCG reportedly holds around 67 million GBTC shares, a number that could definitely have an impact on the market if the company were to dump them. However, DCG is still holding on to its shares, which is good news for the asset, at least for now.

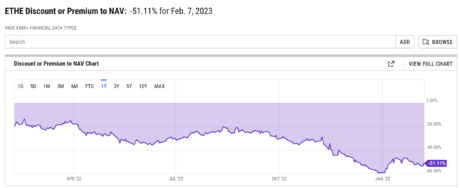

Nevertheless, both the GBTC and the ETHE are still trading at significant discounts to net asset value (NAV). This is because investors are unable to redeem the shares they hold for the digital assets held in the trust. Grayscale is currently locked in a legal battle with the SEC to turn the trust into a spot bitcoin ETF, which it believes would help close the massive discount.

As of the time of writing, the GBTC is trading at a 42.53% discount to NAV, while the ETHE is trading at a 51.11% discount to NAV.

Price analysis 2/6: SPX, DXY, BTC, ETH, BNB, XRP, DOGE, ADA, MATIC, DOT

The U.S. dollar’s rise has put brakes on Bitcoin’s price recovery, but lower levels are likely to attract buyers for BTC and altcoins such as Dogecoin.

Over $16 Million Of Donald Trump NFTs Traded On OpenSea

Over 10,100 ETH worth of former U.S. President Donald Trump NFTs, translating to $ 16 million, have been traded, data from digital marketplace OpenSea shows on February 6.

People Want Donald Trump’s NFTs

The Trump Digital Trading Cards was launched in the ERC-721 format as non-fungible tokens (NFTs) deployed on Polygon by affiliates of Donald Trump, the 45th president of the United States.

45,000 Trump NFTs were minted in December 2022 on Polygon, an Ethereum sidechain. Each NFT was coined for $ 99, and all tokens sold out in less than 12 hours, raising $ 4.35 million.

Holders are incentivized with gifts to use the “Trump Sweepstakes.” Those who hold at least 45 NFTs stand a chance to have dinner with Donald Trump.

For every subsequent sale, the creator of the collection earns 10%. From this, it is estimated that the creator of the Donald Trump NFT collection has made over 1,000 ETH or roughly $ 1.65 million at today’s spot rates. NFT LLC is the team behind the collection. Trump licensed the use of his name but did not, in any way, own, manage, or control the collection.

At the moment, the floor price, or the lowest price the NFT can be sold for, is 0.559 ETH. Nonetheless, the best offer stands at 0.51 ETH, according to OpenSea statistics. Meanwhile, an NFT from the Trump collection was recently sold for 0.6 ETH on February 6.

Interestingly, there are 14,372 owners, of which 32% are unique. According to the creator, each Trump card minted is hand-drawn and inspired by “President Trump’s extraordinary life & career.” Collectors are free to purchase any of the six types of Trump NFTs. Those offered include the unique Trump Trading Cards, Gold & Silver Autographed Cards, and Business Trump.

Demand For NFTs Still High

Out of this collection, the one-of-ones are the rarest and the most expensive. There will be 1,000 of them. One was bought for 8.5 ETH, or $ 13,819.39 at ETH spot rates, in mid-January 2023. Another piece from the one-of-ones collection is also listed for 6 ETH. It depicts the former President holding a torch in front of the Statue of Liberty.

Trump NFTs have also been resilient and consistently drawing traders. Although there was a dip early this month on February 4, trading activity is picking up. To illustrate, the average trading volumes in ETH have risen from 37 ETH on January 31 to 155 ETH on February 3.

OpenSea statistics show that the average trading volumes are up roughly 1% in the past trading week, rising to 655ETH. During this time, 1,373 Trump NFTs have been sold at a floor price of 0.55 ETH. The floor price has also been on an uptrend per OpenSea data.

Polygon Price May Surpass $1.50 In February – Here’s Why

Polygon price is still moving upward and is comfortably above the $ 1.20 mark as it continues its ascent toward $ 2. According to data from CoinMarketCap, the leading Layer-2 blockchain has gained an impressive 67% since the start of the year as the crypto market continues to recover from the extended bearish period of 2022.

Polygon’s growth has been attributed to solid fundamentals, and its native token, MATIC, could surpass $ 1.50 in February due to a few factors.

Polygon Spurred By DeFi Growth

Polygon has performed well in the DeFi sector in the past with its unique infrastructure and low transaction fees attracting new and established platforms to its ecosystem. The latest platform to join this trend is Dopex finance. Polygon announced on February 4 that the decentralized options protocol had launched on its blockchain.

It further stated that this was a step forward for Dopex as it would reach a wider user base and provide opportunities for traders to take advantage of its novel features. Following the announcement, MATIC’s price responded positively, and its daily and weekly charts are in the green zone.

Related reading: MATIC Gains Over 20% As Polygon Network Records Biggest Whale Transaction Of 2023

This development comes after the Polygon team completed a hard fork on its blockchain network. According to Polygon the hard fork would significantly reduce price fluctuations on its network while following the gas mechanisms of Ethereum. It would also ensure that gas fees remain relatively lower during peak periods on its network.

MATIC’s price surge could have been a significant factor in the token’s popularity among crypto whales. According to data from the crypto tracking platform WhaleStats, MATIC surpassed Shiba Inu (SHIB) to become the most-traded token from Ethereum (ETH) whales.

In addition, data from DeFiLlama reveals that the Total Value Locked (TVL) on Polygon has increased since the turn of the year to $ 1.2 billion. Furthermore, the token is among the most discussed on social media, and its daily on-chain transaction volume has also increased.

Polygon Price Shows Strong Fundamentals

Presently, there are positive sentiments regarding the current upward movement of MATIC, and the digital asset is showing solid fundamentals that indicate further price growth. The token is trading well above what was expected this week by several analysts.

Related reading: The Crypto Dream Team: Binance Coin (BNB), Polygon (MATIC), and Orbeon Protocol (ORBN)

MATIC has established support above the $ 1 mark, which means that the bulls are in control, and we could see further consolidation in the coming days. The current resistance level is $ 1.50, and if the trading volumes continue to rise, we could have a price closer to $ 2.

Despite these positive indicators, the market is still fickle, and there’s a slim chance that there could be a pullback before the next price surge. MATIC is currently trading at $ 1.21 at the time of writing. It is down 2.5% in the last 24 hours but has gained 6% in the past week.

Featured image from Capital.com, chart from Tradingview.com

Binance Teams Up With Hong Kong Police To Fight Crypto Crime

Hong Kong has taken its plans of becoming a crypto hub into a new dimension. The latest report says the world’s largest cryptocurrency exchange, Binance, is training the Hong Kong Police Force to fight crypto-related crimes.

As the city moves towards its plans to become Asia’s crypto hub, cybercrime, and crypto-related scams might become prevalent. Therefore, the Special Administrative Region is readying itself ahead of possible issues that might arise when its plans finally fall into place.

Binance, Hong Kong Police Collaborate To Fight Cybercrime

According to Binance’s blog post on February 3, it participated in a Virtual Asset Investigation Course (VAIC) by the Cyber Security and Technology Crime Bureau (CSTCB) of the Hong Kong Police Force (HKPF). The report stated that the police pioneered the course to strengthen law enforcement against the increasing cybercrime in the region.

The training lasted five days and aimed to equip the Hong Kong authorities with the knowledge and capability to fight and prevent crypto-related crime. Binance’s team covered some crucial topics during the course. Some course topics include case studies on cryptocurrency-related investigation techniques and how the exchange can assist criminal investigations with law enforcement agencies.

Head of law enforcement training at Binance, Jarek Jakubcek, noted that his firm takes user security as a top priority and is fully committed to building a secure cryptocurrency ecosystem by supporting and fortifying international security.

Notably, Binance launched its Global Law Enforcement Training Program in 2022. So far, the exchange has conducted more than 70 workshops for many law enforcement agencies. It aims to fight against digital financial crimes and cybercrimes across the globe, especially in the cryptocurrency industry.

Binance is gradually increasing its dominance in the Hong Kong crypto and blockchain industry with these recent moves. The crypto exchange increased its pace in projecting itself into the city’s crypto space after Hong Kong declared plans to become a crypto hub in Asia.

Hong Kong Monetary Authority Sanitizes Crypto Industry, Encourages Licensing

On Thursday, Binance’s CEO, Changpeng Zhao, praised the Hong Kong Monetary Authority’s approach to stablecoin’s oversight and its moves to ban the trade of algorithm stablecoins.

Last week, the Hong Kong Monetary Authority issued a paper discussing the risks associated with stablecoins. As a result, the Special Administrative Region of China stated that they would no longer accept algorithmic stablecoins.

However, stablecoin holders can redeem their assets in fiat currency within a given period. While this news could be disheartening to some stablecoin issuers and holders in Hong Kong, Binance’s CZ applauded the authorities for their decision.

Meanwhile, Hong Kong’s Fin Sec, Paul Chan, encouraged crypto exchanges and other crypto-related firms to register and widen their operational scope in the city. As per Bloomberg reports, Chan said Hong Kong is committed to becoming Asia’s crypto hub and is ready to roll out licenses to companies.

Hong Kong remains a pro-crypto administrative region in contrast with mainland of China. On January 9, during the Hong Kong Web3 Innovator Summit, Paul Chain reaffirmed that the city would continue in its pursuit to become a global crypto hub.

Binance’s latest moves confirm that several crypto and tech firms are planning to move their headquarters or expand in Hong Kong.

Featured Image From Pixabay, 497608 Charts From Tradingview