Top 10 Proof Of Work Blockchains Like Bitcoin

Proof of Work blockchains stand as the cornerstone of cryptocurrency technology, first popularized by Bitcoin, the original cryptocurrency. At their core, these blockchains rely on a consensus mechanism called Proof of Work (PoW). This mechanism is essential for validating transactions and creating new blocks without the need for a central authority.

In a PoW blockchain, miners compete to solve complex mathematical puzzles. The first miner to solve the puzzle gets the opportunity to add a new block to the blockchain and is rewarded with cryptocurrency. This process not only secures the network against fraudulent transactions but also ensures its decentralization and integrity.

The ingenuity of Proof of Work lies in its simplicity and effectiveness. It leverages computational power to maintain network security, making any attempt to alter transaction data not just difficult, but economically not feasible. As the pioneer of this technology, Bitcoin has demonstrated the robustness and reliability of PoW blockchains, setting a benchmark for countless cryptocurrencies that followed.

Understanding Proof Of Work Blockchains

Proof of Work (PoW) blockchains are foundational to the cryptocurrency ecosystem, embodying a consensus mechanism that is both secure and decentralized. This innovative approach to consensus ensures the integrity, security, and continuity of the blockchain without necessitating a central authority.

What Makes A Proof Of Work Blockchain?

A Proof of Work (PoW) blockchain is distinguished by its consensus mechanism, which is intricately designed to ensure network security, decentralization, and transaction integrity through computational effort. This mechanism revolves around several pivotal elements that together define the PoW paradigm:

- Cryptographic Puzzle Solving (Hashing): At the heart of PoW is the requirement for miners to solve complex cryptographic puzzles. These puzzles involve calculating a hash—a fixed-size alphanumeric string—that meets specific criteria set by the blockchain network.

- Adjustable Difficulty Target: The PoW algorithm adjusts the difficulty of the cryptographic puzzle to maintain a constant block time, despite fluctuations in the network’s total hashing power. This dynamic adjustment ensures consistent block creation rates, which are crucial for the stability and predictability of the blockchain.

- Network Security Through Work: The foundational principle behind PoW is that the security of the blockchain is directly proportional to the amount of work (computational power) invested in it. Successfully solving a puzzle requires a significant investment in hardware and electricity, making it economically impractical to conduct attacks.

- Decentralization And Participation: PoW encourages a decentralized network structure by allowing anyone with the necessary computational resources to participate in mining. This openness fosters a competitive mining environment and reduces the risk of centralized control, which is pivotal for the autonomy and resilience of the blockchain.

- Miner Incentivization: Miners are rewarded for their efforts with a combination of block rewards (newly minted coins) and transaction fees.

- Immutability And Trust: The PoW consensus model underpins the blockchain’s immutability. Altering any previously confirmed block would require re-mining not only that block but also all subsequent blocks, a feat that demands an unrealistic amount of computational power.

Advantages Of Proof Of Work Blockchains

The implementation of PoW consensus mechanisms brings forth several advantages that are critical to the functionality and security of blockchain technology:

- Robust Security Model: The sheer computational work required to validate transactions and mine new blocks makes PoW blockchains incredibly secure. This security model effectively prevents the feasibility of 51% attacks, where an entity would need to control the majority of the network’s hashing power to manipulate the blockchain.

- Immutable Ledger: PoW contributes to the immutability of the blockchain, ensuring that once a transaction is confirmed and added to the ledger, reversing it becomes computationally infeasible. This property is vital for trust and reliability in the system.

- Network Integrity: Through the process of mining and the rewards system, PoW blockchains encourage participants to act honestly. The cost of attempting to cheat the system (in terms of wasted computational power and energy) outweighs the potential benefits, thereby maintaining the integrity of the network.

- Transparent And Verifiable: All transactions on a PoW blockchain are transparent and can be independently verified by any participant. This transparency builds trust among users and is fundamental for the operation of a decentralized financial system.

Top 10 Proof of Work Blockchains Like Bitcoin

Below is a list of the top 10 Proof of Work (PoW) blockchains by market cap (as of February 2024):

Bitcoin: The Pioneer Proof Of Work Blockchain

Bitcoin stands as the original and most renowned Proof of Work blockchain. Launched by an anonymous entity or group under the pseudonym Satoshi Nakamoto in 2009, Bitcoin introduced the world to the concept of decentralized digital currency. At its core, Bitcoin operates on a PoW consensus mechanism, which is fundamental to its design for securing transactions and minting new coins.

Technical Innovation:

Technical Innovation:

Bitcoin’s introduction of blockchain technology represented a revolutionary leap forward in digital trust. By enabling a decentralized network of miners to validate transactions by solving complex cryptographic puzzles, Bitcoin solved the double-spending problem without the need for a central authority.

Security:

The security of the Bitcoin network is unparalleled, largely due to the massive amount of computational power contributed by miners around the globe. This distributed network of miners makes it nearly impossible for any single actor to manipulate the blockchain or reverse transactions, ensuring the integrity and trustworthiness of the entire system. The latest study by Lucas Nuzzi, Head of R&D at CoinMetric, showed that a 51% attack would cost at least $ 20 billion and is logistically near impossible.

Impact on Cryptocurrency:

Bitcoin not only pioneered the PoW mechanism but also laid the groundwork for the cryptocurrency industry. Its success has inspired the creation of thousands of alternative cryptocurrencies, many of which have adopted or adapted its PoW model. Bitcoin remains the gold standard in the space, often referred to as “digital gold,” symbolizing its status as a store of value and a hedge against traditional financial systems.

Network and Adoption:

Over the years, Bitcoin has seen exponential growth in both adoption and value. It has transitioned from a niche digital currency to a mainstream financial asset recognized by individuals, corporations, and even some governments. The network continues to grow, supported by a robust and dedicated community of developers, miners, and enthusiasts who ensure its ongoing development and security.

Dogecoin: From Meme To Mainstream

Dogecoin, originally created as a lighthearted joke in 2013, has evolved from a meme-inspired cryptocurrency to a significant player within the Proof of Work (PoW) blockchain ecosystem. Designed by Billy Markus and Jackson Palmer, Dogecoin was intended to mock the wild speculation of the cryptocurrency market. However, its fun and friendly approach led to a vibrant and supportive community, propelling Dogecoin from a humorous experiment to mainstream relevance.

Community and Culture:

Community and Culture:

At the heart of Dogecoin’s unexpected rise to fame is its strong, welcoming community. Unlike other cryptocurrencies that focus on technical aspects or financial gains, Dogecoin emphasizes camaraderie and charitable endeavors. This unique culture has fostered a loyal following, contributing to its resilience and growth.

Technical Foundation:

Despite its whimsical origins, Dogecoin shares the PoW consensus mechanism with Bitcoin, albeit with some modifications. It uses the Scrypt algorithm, which is less energy-intensive compared to Bitcoin’s SHA-256. This choice was strategic, making Dogecoin mining more accessible to individuals without specialized hardware.

Market Impact And Use Cases:

Dogecoin’s journey to mainstream recognition was bolstered by social media and high-profile endorsements, including tweets from celebrities like Elon Musk. These endorsements have led to significant price fluctuations, highlighting Dogecoin’s volatility but also its growing relevance as both a digital currency and a cultural phenomenon.

Initially intended for tipping and small transactions on social media, Dogecoin’s use cases have expanded. It is now accepted by a variety of merchants and has been used in fundraising for charitable causes, showcasing its utility beyond mere speculation. Despite its origins, Dogecoin has demonstrated real-world value, contributing to its endurance in the crypto space.

Future Prospects:

Dogecoin continues to evolve, with its community and developers exploring ways to improve its functionality, efficiency, and scalability. While it may not match the technical ambitions of other cryptocurrencies, Dogecoin’s strength lies in its unique blend of humor, heart, and a committed community, making it a noteworthy and enduring participant in the Proof of Work blockchain landscape.

Litecoin: The Silver To Bitcoin’s Gold

Litecoin, created by Charlie Lee in 2011, is often considered the silver to Bitcoin’s gold. It was developed to address some of the perceived limitations of Bitcoin, primarily aiming to offer faster transactions and lower fees. As a Proof of Work (PoW) blockchain, Litecoin shares many of Bitcoin’s core principles but introduces key technical adjustments that distinguish it within the cryptocurrency space.

Technical Innovations:

One of the most significant innovations of Litecoin is its use of the Scrypt hashing algorithm, as opposed to Bitcoin’s SHA-256. The Scrypt algorithm is less susceptible to the kind of high-powered ASIC mining rigs that dominate Bitcoin mining. This decision was made to democratize mining, allowing individuals with less specialized hardware to participate in the network. Moreover, Litecoin offers faster block generation times—approximately 2.5 minutes compared to Bitcoin’s 10 minutes—enabling quicker transaction confirmations.

Market Position And Adoption:

Since its inception, Litecoin has consistently ranked among the top cryptocurrencies by market capitalization. Its longevity and stability have earned it a trusted position in the market. Merchants and users who seek faster transactions with lower fees have adopted Litecoin, using it for a variety of transactions, from e-commerce to cross-border payments.

Security And Network:

Despite its faster transaction times and different mining algorithm, Litecoin maintains a robust level of security. The PoW consensus mechanism, coupled with the widespread distribution of miners, ensures that the network remains decentralized and resistant to attacks. Litecoin’s active developer community continues to innovate, proposing upgrades and improvements to enhance security, scalability, and user experience.

Community And Future Directions:

Litecoin benefits from a strong, active community that supports its development and adoption. This community involvement has been crucial for Litecoin’s resilience and growth. Educational resources, developer contributions, and merchant adoption initiatives are regularly supported by the community, fostering a healthy ecosystem around the cryptocurrency.

Litecoin’s roadmap includes ongoing efforts to improve scalability and privacy on the network. Innovations such as the MimbleWimble extension block (MWEB) aim to enhance privacy features, addressing one of the criticisms of Litecoin and other similar cryptocurrencies. These developments indicate Litecoin’s commitment to evolving in response to user needs and technological advancements.

Bitcoin Cash: The Result Of The “Blocksize War”

Bitcoin Cash emerged in 2017 as a direct response to the debates surrounding Bitcoin’s scalability challenges. Created from a hard fork of Bitcoin, it aims to fulfill the original vision of Bitcoin as a peer-to-peer electronic cash system with enhanced transaction speed and lower fees. As a Proof of Work (PoW) blockchain, Bitcoin Cash retains many of Bitcoin’s fundamental characteristics while introducing critical changes to improve scalability and usability.

Technical Enhancements For Speed:

The primary distinction between Bitcoin Cash and its predecessor lies in its block size. Bitcoin Cash increased the block size limit from 1 MB to an initial 8 MB, with subsequent upgrades allowing blocks up to 32 MB. This expansion significantly increases the number of transactions that can be processed per block, reducing transaction fees and improving processing times. These changes address one of the core issues Bitcoin faced—its inability to process transactions quickly during peak usage times.

Market Reception And Adoption:

Since its inception, Bitcoin Cash has secured a place among the top cryptocurrencies by market capitalization. Its commitment to maintaining low transaction fees and fast processing times has attracted users and merchants looking for efficient digital transactions. The cryptocurrency has seen adoption for a variety of uses, including online payments, remittances, and as a means of exchange for goods and services.

Security And Decentralization:

Despite the changes in block size, Bitcoin Cash continues to uphold the security standards set by Bitcoin. The PoW consensus mechanism ensures the network remains secure against attacks, and the decentralized nature of mining activities promotes network health and integrity. However, debates have arisen within the community regarding the potential for centralization due to the increased block size, which could, theoretically, require more substantial computational resources to mine effectively.

Looking Forward:

The future of Bitcoin Cash hinges on its ability to balance scalability, security, and decentralization. Ongoing efforts to enhance the network’s underlying technology and address challenges related to block size and transaction efficiency are critical.

However, it needs to be pointed out that BCH has somewhat failed against Bitcoin. It has not managed to match BTC in terms of price performance. The following chart illustrates the price comparison of Bitcoin Cash to Bitcoin since 2017. Despite having backing from key figures like Roger Ver, BCH has not seen widespread adoption, mostly because of limited demand for its increased block size.

Ethereum Classic: Preserving Originality

Ethereum Classic (ETC) emerged from a philosophical divide within the Ethereum community, following a contentious hard fork in 2016. This split was the result of differing opinions on how to handle the aftermath of the DAO attack, a significant security breach that led to the loss of millions of dollars worth of Ethereum.

ETC embodies the principle of “code is law,” maintaining the original Ethereum blockchain without reversing the DAO attack transactions. As a Proof of Work (PoW) blockchain, Ethereum Classic upholds the sanctity of immutability and the original vision of Ethereum as an unalterable digital ledger.

Technical Foundation And Development:

The core ethos of Ethereum Classic is its unwavering commitment to blockchain immutability. In the blockchain context, immutability refers to the principle that once transactions are confirmed, they cannot be altered or reversed. Ethereum Classic’s stance on this principle reflects a fundamental belief in the importance of preserving the integrity of the blockchain, even in the face of challenges and disputes.

Despite sharing its roots with Ethereum, Ethereum Classic operates as a distinct entity with its development path. It maintains the original Ethereum blockchain’s capabilities, supporting smart contracts and decentralized applications (DApps) with the added emphasis on security and stability.

Security Considerations:

Ethereum Classic’s commitment to preserving the original Ethereum blockchain has not come without its challenges, particularly in the realm of security. The network has been subject to several 51% attacks, where attackers gained majority control of the network’s hash rate, enabling them to double-spend coins. These incidents have sparked discussions about the security of PoW blockchains, especially those with a smaller network size and hash rate compared to their larger counterparts.

Development And Future Outlook:

In response to security challenges, the Ethereum Classic community and its developers have been working on solutions to enhance network security and prevent future attacks. Proposals include modifying the consensus mechanism to make 51% attacks more difficult and expensive to execute. Additionally, Ethereum Classic continues to evolve, with ongoing development efforts aimed at improving scalability, interoperability, and the overall utility of the network.

Kaspa: The Newcomer

Kaspa emerges as the latest entrant in the Proof of Work (PoW) blockchain arena, distinguishing itself through innovative technology and a forward-thinking approach to scalability and transaction speed. As a newcomer, Kaspa aims to address some of the most pressing issues faced by traditional PoW blockchains, such as Bitcoin and Ethereum Classic, by introducing a novel blockDAG (Directed Acyclic Graph) structure.

This groundbreaking architecture enables Kaspa to offer unprecedented transaction throughput and minimal confirmation times, setting a new standard for performance in the PoW landscape.

Innovative Architecture And Scalability:

The core innovation behind Kaspa is its use of a blockDAG framework, a departure from the traditional blockchain linear model. In this structure, blocks are connected in a DAG pattern, allowing for multiple blocks to be added to the network simultaneously. This parallel processing capability significantly increases the network’s capacity and transaction speed, effectively addressing the scalability limitations inherent in conventional blockchain systems.

Kaspa’s blockDAG architecture allows it to process thousands of transactions per second (TPS), a remarkable feat compared to the transaction throughput of legacy PoW blockchains. Furthermore, the DAG structure reduces transaction confirmation times to mere seconds, enhancing the user experience and making Kaspa an attractive platform for real-time applications and microtransactions.

Market Position And Adoption:

As a newcomer, Kaspa faces the challenge of establishing itself in a market dominated by well-entrenched blockchains. However, its technological advancements and promise of high scalability and low transaction costs have garnered attention from developers, miners, and users alike.

Security And Decentralization:

Despite its novel architecture, Kaspa remains committed to the principles of security and decentralization that are hallmarks of PoW blockchains. The blockDAG structure, while more complex than a linear blockchain, is designed to maintain a high level of security against attacks, including double-spending and 51% attacks. Moreover, Kaspa’s PoW consensus mechanism ensures that the network remains decentralized, with no single entity able to control the majority of the hashing power.

Future Directions And Challenges:

Looking forward, Kaspa aims to continue its trajectory of rapid development and community growth. The project’s roadmap includes enhancements to its core protocol, improvements in user interface and experience, and the exploration of new use cases enabled by its high-speed, scalable infrastructure.

However, Kaspa’s success will depend on its ability to overcome the challenges of network security, user adoption, and competition from both established blockchains and emerging technologies.

Monero: Privacy As A Priority

Monero stands out in the Proof of Work blockchain space with its unwavering commitment to privacy and security. Unlike many cryptocurrencies that offer transparent blockchain transactions, Monero ensures the anonymity of its users through advanced cryptographic techniques. This focus on privacy makes Monero a favored choice for individuals seeking financial confidentiality in their transactions.

Advanced Privacy Features:

Advanced Privacy Features:

At the heart of Monero’s privacy mechanism are ring signatures, stealth addresses, and Ring Confidential Transactions (RingCT). Ring signatures obscure the sender’s identity by mixing their transaction with others’, making it virtually impossible to trace the transaction back to its origin.

Stealth addresses add another layer of privacy by creating a one-time address for each transaction, protecting the recipient’s identity. RingCT further enhances privacy by concealing the transaction amount, ensuring all aspects of a transaction are kept confidential.

Monero’s advanced privacy features ensure that users can conduct transactions without the fear of surveillance or tracking. This level of anonymity is critical in an era where financial privacy is increasingly under threat. By encrypting transaction details, Monero provides a secure environment for users to send and receive funds without exposing their financial activities to the public or any prying eyes.

Market Adoption and Use Cases: Monero’s focus on privacy has led to a broad range of use cases, from individuals seeking to protect their financial privacy to businesses requiring confidential transactions. However, this emphasis on anonymity has also attracted controversy, with Monero being associated with illicit activities on the dark web.

Regulatory Challenges And Future Outlook:

The privacy features that make Monero attractive to users also pose significant challenges in terms of regulatory compliance. Governments and financial institutions are increasingly concerned about the potential for cryptocurrencies like Monero to be used for money laundering and other illegal activities. Several crypto exchanges worldwide have already delisted Monero, pressured by local governments and laws.

As the digital landscape evolves, Monero’s commitment to privacy remains unwavering. The development team and community are continually working on improving Monero’s privacy features and usability, ensuring that it remains at the forefront of secure and private digital transactions. Despite regulatory hurdles, Monero’s dedication to protecting user privacy positions it as a critical player in the ongoing discourse on financial privacy and security in the digital age.

Bitcoin SV: Craig Wright’s Vision

Bitcoin SV (BSV) represents a distinctive branch in the evolution of Bitcoin, advocating a return to what its proponents consider Satoshi Nakamoto’s original vision for the cryptocurrency. It emerged from a hard fork of Bitcoin Cash (BCH) in 2018, centering around disagreements on the direction and scalability of Bitcoin.

Craig Wright, a polarizing figure in the cryptocurrency community, has been a vocal advocate for Bitcoin SV, claiming it to be the true Bitcoin as originally intended by Satoshi Nakamoto. However, it’s crucial to note that Craig Wright’s assertions of being Satoshi Nakamoto are marred by controversy and lack conclusive evidence. The ongoing COPA (Crypto Open Patent Alliance) trial further scrutinizes Wright’s claims, highlighting discrepancies and alleged falsehoods in his assertions.

Controversy Surrounding Craig Wright: Wright’s claim to be Satoshi Nakamoto, the pseudonymous creator of Bitcoin, has been a subject of intense debate and legal scrutiny. Despite his assertions, Wright has not provided irrefutable cryptographic proof of ownership of the early Bitcoin keys, a step that would be essential to conclusively proving his identity as Satoshi.

The COPA trial, among other legal challenges, casts a long shadow over Wright’s claims, with the crypto community and wider public remaining skeptical of his assertions due to the lack of verifiable evidence and the emergence of contradictory statements.

Bitcoin SV’s Proposition:

Despite the controversies surrounding its main proponent, Bitcoin SV aims to fulfill what its supporters believe was Nakamoto’s original vision for Bitcoin — a peer-to-peer electronic cash system capable of scaling massively to serve as a global payment system.

Bitcoin SV advocates for larger block sizes to handle more transactions and reduce fees, a key point of divergence from Bitcoin (BTC) and Bitcoin Cash (BCH). The network has implemented significant block size increases, aiming to facilitate greater transaction throughput and enable a wide range of applications, from micropayments to enterprise-level data processing.

Looking Forward:

Bitcoin SV’s market position has been influenced by its technical propositions as well as the controversies of its leading figure. While it has established a niche within the broader cryptocurrency ecosystem, BSV’s adoption and acceptance have been impacted by the ongoing debates over Wright’s claims to be Satoshi Nakamoto. BSV has never ever gained much traction. The BSV/BTC chart shows the lackluster performance.

Conflux Network: Bridging East And West

Conflux Network emerges as a unique Proof of Work (PoW) blockchain with a mission to bridge the technological and regulatory divides between the East and West. Leveraging a novel tree-graph consensus mechanism, Conflux Network aims to offer high throughput, scalability, and security without compromising decentralization — a proposition that addresses some of the most pressing challenges in blockchain technology.

Innovative Consensus Mechanism:

At the heart of Conflux Network’s innovation is its tree-graph consensus algorithm, which allows for the concurrent processing of blocks and transactions. This design significantly enhances the network’s capacity and speed, enabling higher transaction throughput compared to traditional blockchain systems. This technical advancement is crucial for achieving the network’s vision of supporting global decentralized applications (dApps) and services.

Strategic Positioning In The Global Market:

Conflux Network has strategically positioned itself as a bridge between the Eastern and Western worlds in the context of blockchain technology and cryptocurrency. By complying with regulatory standards in China, where it is primarily based, Conflux has managed to secure a unique position in one of the largest markets in the world. This compliance has opened avenues for collaboration with government and private sector projects, distinguishing Conflux from many other blockchain projects that face regulatory challenges.

Through its commitment to regulatory compliance and its technological infrastructure, Conflux Network facilitates cross-border collaboration and transactions. It aims to foster a global ecosystem where developers, enterprises, and users from different jurisdictions can participate in the blockchain economy with reduced friction and increased trust. By doing so, Conflux not only addresses technical challenges but also navigates the complex landscape of international regulations and policies.

Challenges And Opportunities:

Despite its innovative approach and strategic advantages, Conflux Network faces challenges common to many blockchain projects, including the need for wider adoption and recognition in the crowded cryptocurrency space.

However, its unique position as a compliant, scalable, and high-throughput blockchain presents significant opportunities. By continuing to build partnerships and expand its ecosystem, Conflux has the potential to play a pivotal role in the global blockchain landscape, facilitating a more interconnected and efficient digital economy.

Siacoin: Revolutionizing Storage

Siacoin stands out in the blockchain ecosystem as a pioneering platform aimed at revolutionizing digital storage by decentralizing it. As a proof of work (PoW) blockchain, Siacoin offers a secure, private, and cost-effective solution for storing data across a distributed network. This approach not only challenges traditional cloud storage providers but also aligns with the growing demands of the AI and decentralized private networks (DePIN) sectors for reliable, scalable storage solutions.

Decentralized Storage For AI:

In the era of AI, the need for vast amounts of data storage is undeniable. AI models require extensive datasets for training and operation, often entailing significant storage costs and security concerns. Siacoin’s decentralized storage model offers a compelling solution by distributing data across a global network of nodes. This method ensures redundancy, lowers costs, and enhances data privacy and security — key advantages for AI developers and companies seeking efficient ways to manage their data.

The concept of DePIN (Decentralized Private Networks) is gaining traction as a means to enhance privacy and security in digital communications and transactions. Siacoin’s infrastructure naturally complements this sector by providing a decentralized storage solution that can be integral to DePIN architectures. By ensuring data is stored securely and spread across multiple nodes, Siacoin mitigates risks associated with centralized data breaches and offers a robust foundation for DePIN applications.

The intersection of AI and cryptocurrency is an exciting frontier for innovation. Siacoin directly contributes to this narrative by addressing one of the most pressing needs in the AI space: scalable and secure data storage.

The platform’s use of blockchain technology ensures integrity and accessibility of data, which is crucial for AI applications that rely on vast datasets. Additionally, Siacoin’s payment model, which uses its native cryptocurrency (SC) for transactions, seamlessly integrates with the crypto economy, providing a streamlined approach for users to engage with decentralized storage services.

Innovation And Looking Ahead:

While Siacoin presents a groundbreaking approach to data storage, it also faces challenges typical of decentralized platforms, such as user adoption, competition from established cloud storage providers, and the ongoing need to prove its reliability and efficiency at scale. However, its innovative use of blockchain technology to disrupt the traditional storage market positions Siacoin as a potential key player in the future of both the blockchain and AI industries.

As the demand for AI capabilities continues to grow, alongside the increasing importance of privacy and security in the digital realm, Siacoin’s role in the ecosystem could become increasingly pivotal. Its ability to provide a decentralized, secure, and cost-effective storage solution places it at the heart of the convergence between blockchain technology and AI.

The ongoing development of the platform and its adoption by the AI and DePIN sectors will be critical in determining its success and impact on the broader technology landscape.

Comparative Analysis Of Top Proof Of Work Blockchains

The landscape of Proof of Work blockchains is diverse, with each platform offering unique features, advantages, and challenges. This comparative analysis aims to shed light on the top PoW blockchains like Bitcoin, exploring their speed, security, scalability, community, and developer support. Understanding these facets can help users, investors, and developers make informed decisions in the blockchain space.

Speed:

Transaction speed is a critical metric for any blockchain. Bitcoin, the first and most well-known Proof of Work blockchain, processes transactions relatively slowly, with a capacity of 7 transactions per second (TPS) on the base layer. In contrast, newer blockchains like Kaspa aim to dramatically increase transaction speeds using novel consensus mechanisms, claiming to support thousands of TPS. Litecoin and Bitcoin Cash have also implemented various improvements to increase their transaction speeds and reduce confirmation times compared to Bitcoin.

Security:

Security is paramount in the blockchain world. PoW blockchains are renowned for their robust security models. Bitcoin remains the gold standard in security, leveraging its extensive network of miners to prevent attacks. Monero offers additional security features focused on privacy, using ring signatures and stealth addresses to protect user identities. While all Proof of Work blockchains prioritize security, the trade-off often comes in the form of increased energy consumption and slower transaction speeds.

Scalability:

Scalability:

Scalability remains a significant challenge for Proof of Workblockchains. Bitcoin has faced scalability issues, leading to high transaction fees and slower processing times during peak usage. Solutions like the Lightning Network for Bitcoin and sidechains like Stacks (STX) are being developed to address these limitations. Kaspa’s unique approach to scalability through its GHOSTDAG protocol highlights the ongoing innovation in this area, promising more scalable solutions within the PoW paradigm.

Community And Developer Support:

A strong community and developer support are crucial for the growth and sustainability of any blockchain. Bitcoin boasts the largest, active community of developers, contributing to the resilience and continuous improvement. Dogecoin, initially started as a joke, has garnered a massive community following, which has played a significant role in its adoption and endurance. Newer entrants like Kaspa and Conflux Network are rapidly building their communities, emphasizing the importance of engagement and support for long-term success.

FAQ: Top Proof of Work Blockchains

What Are The Top Proof Of Work Blockchains?

The top Proof of Work blockchains, known for their robust security and decentralization, include Bitcoin, Dogecoin, Litecoin, Bitcoin Cash, Ethereum Classic, Kaspa, Monero, Bitcoin SV, Conflux Network, and Siacoin. These blockchains leverage the Proof of Work consensus mechanism to validate transactions and secure their networks.

What Are Proof Of Work Blockchains?

Proof of Work blockchains are a type of decentralized ledger technology that uses a consensus mechanism requiring participants (miners) to solve complex mathematical problems to validate transactions and create new blocks. This process ensures security and integrity within the blockchain, preventing fraud and double-spending.

What Is The Biggest Proof Of Work Blockchain?

Bitcoin is the largest and most well-known Proof of Work blockchain in terms of market capitalization, user base, and network security. It was the first cryptocurrency to implement the Proof of Work mechanism, setting the standard for many that followed.

Who Invented Proof Of Work Blockchains?

The concept of Proof of Work predates Bitcoin, but Satoshi Nakamoto, the pseudonymous person or group of people who developed Bitcoin, was the first to implement it as a consensus mechanism for a cryptocurrency blockchain in 2009. This innovation paved the way for the development of other Proof of Work blockchains.

How Do I Invest In Top Proof Of Work Blockchains?

Investing in top Proof of Work blockchains typically involves buying the blockchain’s native cryptocurrency through a crypto exchange. Potential investors should create an account on a reputable exchange, deposit funds (fiat or crypto), and then purchase the desired cryptocurrency.

What Are the Alternatives To Proof Of Work Blockchains?

Alternatives to Proof of Work blockchains include Proof of Stake (PoS), Delegated Proof of Stake (DPoS), and other consensus mechanisms like Proof of Authority (PoA) and Proof of Space and Time. These alternatives seek to address some of the limitations of Proof of Work, such as its high energy consumption, by offering more energy-efficient and scalable solutions.

Solana Drops Below 100-Day MA On 4-Hour Chart, SOL Price In Danger?

Having failed to break its previous high for the year, the price of Solana has continued to move downward. From the height of $ 118.88, the coin, which is currently ranked 5th in the crypto space with a total supply of 440,961,455 SOL and a market capitalization of $ 58.2 million, has made a drop of over 25% and is not showing any signs of stopping.

As of the time of writing, the price of SOL was up by 2.76% and trading around $ 102.63, below the 100-day moving average in the last 24 hours. Meanwhile, in the daily timeframe, the price has dropped a bearish candlestick, indicating that the price is still bearish.

The moving average indicator generally is used to determine the trend of an asset, which could be an uptrend or downtrend. Since the price of Solana is trading below the 100-day moving average, could this mean that the price has changed from an uptrend to a downtrend?

Solana On The 4-Hour Chart

A technical examination of the chart from the 4-hour timeframe and with the help of a trend line we can see that two resistance levels of $ 118.88 and $ 114.87 have been created by previous price movement. We can also see that the price has broken the support level of $ 103.57. Therefore, the price for the next destination might be the $ 92.84 support level.

This can be seen in the image below:

Also, taking a look at the 4-hour timeframe chart with the help of the MACD indicator in the above image, we can see that the MACD histogram is trending below the MACD zero line. Both the MACD line and the signal line have crossed and are trending below the MACD zero line, suggesting that the price of SOL is bearish and could continue to move downward.

A final look at the chart with the help of the Bull Power Vs. Bear Power Histogram indicator, we can see that the histograms are trending below the zero line. This suggests that buyers have completely lost momentum in the market, and sellers have taken over it. Thus, the price will tend to move downward.

We can see this in the image below:

Possible Outcomes If The SOL Price Continues To Drop

If SOL continues to drop, we might see the price moving toward the support level of $ 92.84. Also, if it manages to break below this level, the price might move further downward toward the $ 79.32 support level.

Presently, Solana is seeing minor upsides of 1.3% in the last 24 hours, according to data from CoinMarketCap.

Is Altcoin Season Upon Us? Here’s What Bitcoin’s Performance Shows

There is reason to believe that the altcoin season is imminent based on Bitcoin’s recent price action. Altcoin season is known to be a period when other crypto tokens begin to outperform the flagship crypto token.

Bitcoin To Cool Off For Altcoin Season

Crypto analyst Rekt Capital stated in an X (formerly Twitter) post that Bitcoin has only one last Pre-Halving retrace before it goes on a parabolic move post-halving. Crypto analyst Sjuul also highlighted in an X post how the funding rate is “mildly high” for Bitcoin at the moment, something which hints that a correction was on the horizon.

With Bitcoin likely to face a significant correction, this presents the perfect opportunity for altcoins to make a run of their own. Ethereum, the second-largest crypto token by market cap, looks set to lead the pack, hitting $ 3,000 for the first time in nearly two years. Meanwhile, some analysts have noted indicators that confirm that the Altcoin season is not far off.

Crypto analyst Crypto Prof noted that the Gaussian channel on the Altcoins chart has turned green after almost 4 years. Also, these altcoins are said to have broken through the previous resistance from the last weekly close. Crypto Prof further stated that the same thing happened in 2016 and 2020, the period in which the Altcoin bull run started.

Stockmonkey Lizards, another crypto analyst, also mentioned on his X platform that the altcoin is close. In the accompanying chart on his post, he highlighted how the altcoin market cap was going to run to $ 10 trillion from its current market cap of almost $ 900 billion.

Investors Increasing Their Risk Appetite

On-chain intelligence platform Glassnode noted in a recent report that their Altseason Momentum indicator has shown a “growing appetite from investors to move capital further out on the risk curve.” This suggests that crypto investors are more willing to deploy a significant amount of their capital to altcoins in anticipation of greater returns.

Interestingly, this altcoin indicator is said to have signalled positive momentum since October 2023 before briefly cooling off during the sell-the-news event that occurred after the Spot Bitcoin ETFs approval. However, the indicator is once again signalling this positive momentum having been retriggered on February 4.

Glassnode further revealed that, while Bitcoin dominance remains significant, there are signs that capital is being rotated into other ecosystems like Ethereum, Solana, Polkadot, and Cosmos.

Data from Blockchain Center also shows that the market is gearing closer to an altcoin season. The altcoin season index currently stands at 61%, with a rise to 75% still needed before it can be said that the altcoin season is in full swing.

Cardano Poised For Massive Rally As Key Indicators Signal Bullish Reversal, ADA Surges 14%

ADA, the native token of the Cardano ecosystem, has experienced a notable surge in price, taking advantage of Bitcoin’s (BTC) stagnation above the $ 52,000 level. With gains of 20% and 14% over the past thirty and fourteen days, respectively, ADA has reignited bullish sentiment among investors.

The token’s recent performance has not gone unnoticed, as crypto analyst “Trend Rider” makes a bold price prediction, highlighting key indicators that suggest a potential long-term bull run for ADA.

ADA’s Potential Bull Run Ahead

In a social media post on X (formerly Twitter), Trend Rider emphasized that ADA is striving to consolidate above the crucial $ 0.600 mark, which holds significant prospects for the token’s future.

The analyst drew attention to an indicator called Impulse colors, which tracks the price distance from key moving averages. During the bear market, opposing trends were predominantly indicated by fuchsia and pink hues as seen in the chart below.

However, recent weeks have witnessed a return to dark blue, the most bullish color on this scale. Notably, this shift in momentum last occurred in 2020 when ADA’s price surged from $ 0.03 to $ 1.4 before the re-emergence of pink hues.

Furthermore, Trend Rider highlighted another positive development— the Wave Oscillator has re-entered the positive zone after 20 months. According to the analyst, this shift indicates growing bullish momentum for ADA.

The pivotal level identified in this context is the $ 0.60 mark. To solidify this shift, ADA’s price must hold and close above $ 0.60, which may catalyze a bullish long-term breakout.

It is worth noting that this analysis is based on the 1-month timeframe, which significantly influences long-term market movements.

These indicators suggest that ADA may be poised for a sustained uptrend, potentially paving the way for a long-term bull run.

Cardano Sustained Bullish Trend

According to the one-day ADA/USD chart below, Cardano’s token reached a 21-month high of $ 0.679 on December 28, which marked the beginning of a period of volatility in ADA’s price. Following a price correction, ADA dropped to $ 0.449 on January 23.

However, in line with the overall market trend, ADA has regained bullish momentum. Nonetheless, this upward movement may face resistance from bears as it encounters various obstacles.

If the current uptrend continues in the coming weeks, ADA must overcome significant resistance levels that have hindered its growth above the $ 0.679 mark.

Successful consolidation above the critical $ 0.600 level will be crucial. ADA will face the $ 0.637 obstacle soon before potentially surging above $ 0.670, the last hurdle before reaching $ 0.700. Reaching this milestone would position Cardano’s native token favorably to target the $ 1 mark, benefiting from the overall market growth expected in the coming months of 2024.

Adding to the bullish prospects for Cardano, ADA has been establishing higher lows and higher highs during its price surge, indicating a healthy price action and a sustained bullish trend. However, it remains to be seen whether this trend can be sustained or if bears will dictate ADA’s future price direction.

Featured image from Shutterstock, chart from TradingView.com

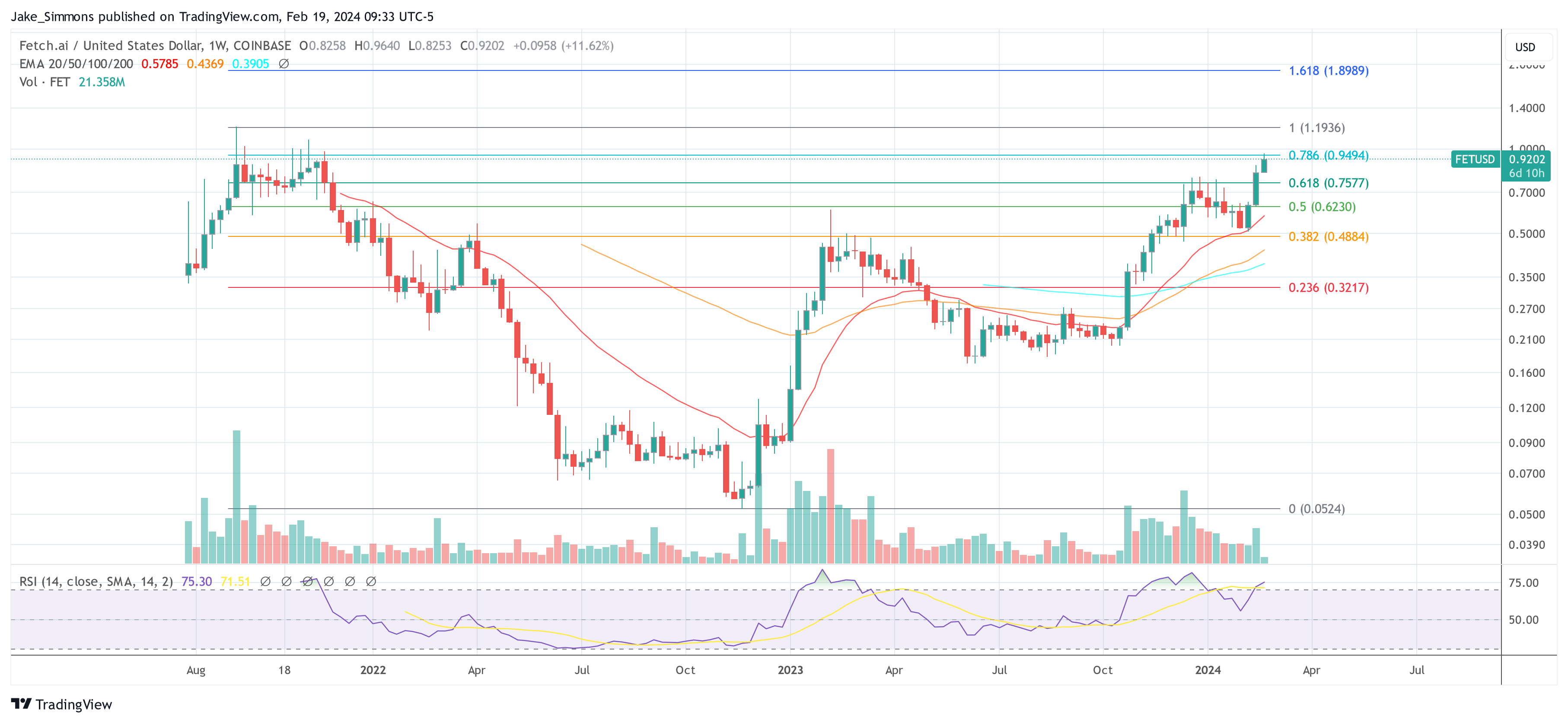

Fetch.AI (FET) Prints Strong Bullish Signal, Targets 500% Spike

In a new technical analysis, renowned crypto analyst Gert van Lagen forecasts a 500% surge in the value of Fetch.AI (FET), with a price target of $ 5.5. This bold prediction comes as the AI-centric cryptocurrency coin, FET, records a 12% increase over the past 24 hours and an impressive 45% gain over the last week.

Currently trading with a momentum that correlates with the buzz around AI technology giant Nvidia, Fetch.AI is riding the wave of heightened interest as Nvidia approaches its Q4 2023 earnings release on February 21.

Nvidia’s stock has experienced a remarkable 45% surge since their previous earnings report, expanding its market cap by an unprecedented $ 600 billion. As the tech community anticipates Nvidia’s next financial update, speculation abounds regarding the potential influence of the company’s performance on the broader AI and cryptocurrency markets.

FET, along with other AI-tied tokens such as The Graph (GRT), Injective (INJ), Render Network (RNDR), and SingularityNET (AGIX), stands at a critical juncture where Nvidia’s financial results could significantly sway investor sentiment within the AI and crypto sectors. A positive report from Nvidia could catalyze a wave of enthusiasm, potentially bolstering investments in AI-dedicated cryptocurrencies.

Fetch.AI (FET) Eyes A 500% Rally

Van Lagen’s chart showcases a massive inverse ‘Head and Shoulders’ (H&S) pattern, consisting of three troughs: the left shoulder formed in early 2022, the head reached its nadir at the end of 2022, and the right shoulder developed in August 2023.

The pattern is characterized by a ‘neckline,’ which is a resistance level that the price must surpass to confirm the reversal. For Fetch.AI, the neckline is situated around the $ 0.5 mark, a threshold that was successfully retested as support in January 2024. This retest is seen as a bullish confirmation, reinforcing the integrity of the reversal pattern.

A noteworthy element in the analysis is the decisive breakout from the green Fibonacci resistance zone last week. The Fibonacci retracement tool is commonly used to ascertain potential support and resistance zones, and a breach beyond these confines typically suggests a strong market conviction.

Thus, Fetch.AI has not only surmounted the neckline but has also made strides past the resistance zone, paving the way for the asset to strive towards new all-time highs. Van Lagen has calculated a technical target for the iH&S pattern at $ 5.5, extrapolated from the depth of the pattern’s head to the neckline, and projected upwards from the breakout point.

The analyst has also stipulated a condition for the invalidation of this bullish scenario: should Fetch.AI print a ‘lower low’ (LL), it would disrupt the structure of the iH&S pattern and potentially signal a bearish shift in the market’s sentiment. He summarizes:

FET [1W] – Head and Shoulders bottom playing out neatly: + Dec-23 breakout of the right shoulder & the green Fib resistance zone; + Jan-24 multi-week successful retest of the neckline; + Feb-24 clearance for new ATHs Technical target iH&S: $ 5.5 Invalidation: print LL

At press time, FET traded at $ 0.92.

Cardano Solid Stats: ADA Soars 14% On Rising TVL and Market Cap – Details

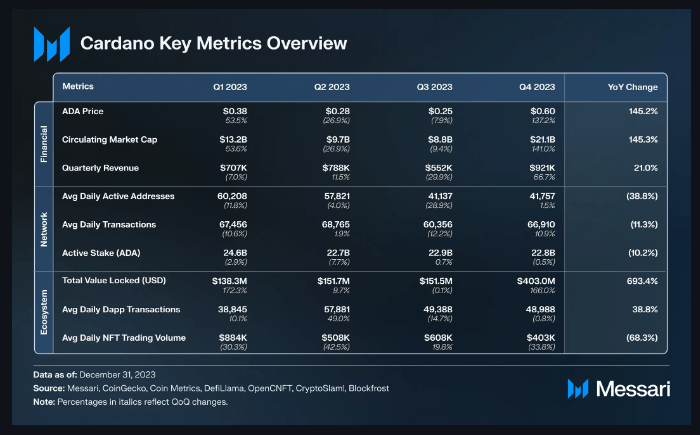

Cardano (ADA), the eighth-largest cryptocurrency by market cap, has defied the recent market downturn, experiencing a 14% price jump in the past week. This bullish momentum can be attributed to a combination of factors, including impressive ecosystem growth, strong technical analysis, and increasing investor confidence.

Cardano TVL Skyrockets, Stablecoins Gain Traction

The recent Messari Q4 2023 report paints a vibrant picture of Cardano’s ecosystem. The network saw a staggering 166% quarter-over-quarter (QoQ) increase in Total Value Locked (TVL), reaching a record-breaking $ 450 million. This translates to a remarkable 693% year-over-year (YoY) jump, showcasing the rapid expansion of Decentralized Finance (DeFi) activity on Cardano.

The growth wasn’t just limited to overall TVL. Stablecoin adoption witnessed a significant 37% QoQ and 673% YoY surge, highlighting their growing role in the Cardano ecosystem. This increasing stability attracts more users and facilitates various DeFi activities like borrowing, lending, and trading.

The report also credits established protocols like MinswapDEX and the newly launched Indigo Protocol with driving this expansion. Indigo, a synthetic derivatives exchange, emerged as the largest protocol by TVL, surpassing even Minswap. This diversity within the ecosystem presents exciting opportunities for future growth.

Technicals Point To Continued Gains

Beyond fundamentals, technical analysis suggests further upside potential for ADA. After a brief price correction, Cardano formed a bullish pennant pattern, typically indicating a continuation of the uptrend after a consolidation period. This technical formation aligns with the positive sentiment surrounding the project and adds another layer of confidence for investors.

The recent price breakout from the pennant confirms this bullish outlook. With a market valuation of more than $ 21 billion, Cardano securely ranks among the 10 leading crypto assets. This impressive valuation reflects the widespread recognition of Cardano’s potential.

Furthermore, the past 24 hours alone saw a 21% rally in trading volume, amounting to nearly $ 730 million. This surge in activity indicates continued strong interest from investors amidst the current upward price movements.

ADA’s price fluctuated between $ 0.58 and $ 0.62 throughout the week, showcasing a stable ascending pattern and solidifying the gains. Crypto expert Dan Gambardello further fueled the excitement, suggesting that ADA has the potential to reach the coveted $ 1 milestone, exceeding expectations despite market volatility.

Development Engine Roars: Hydra And Mithril Push Innovation

Cardano’s strength isn’t limited to price and TVL. The network boasts a thriving developer community actively building the future of the ecosystem. The Cardano Hydra team is diligently working on version 0.15.0, focused on enhancing scalability and transaction throughput. Significant progress has been made on smoke testing and website publishing workflows, bringing Hydra closer to reality.

Moreover, the Mithril team recently released the initial version of the Mithril client NPM package, marking another step towards secure and efficient smart contract development on Cardano. These ongoing advancements solidify Cardano’s commitment to innovation and position it well for future adoption.

Featured image from Adobe Stock, chart from TradingView

UNI Jumps Over 12% – Here’s Why Investors Flock To This Token

A few outliers continue to break through the bearish attitudes looming over the crypto horizon of late. UNI is one of those tokens, with an impressive jump of over 12% in the past 24 hours, investors have flocked to this altcoin in search of a bullish continuation.

The first quarter of this year brings a lot to the table for investors. Just this month, Uniswap reported that its deployment on Arbitrum led to the swap volume on the latter to jump by a significant amount. The news is also coupled with exciting new info on Uniswap’s latest agenda: the launch of Uniswap v4.

Arbitrum swap volume has grown more than 4x since this time last year

pic.twitter.com/w4iEhKGUty

— Uniswap Labs

(@Uniswap) February 16, 2024

What Is Uniswap V4?

After news that Ethereum, Uniswap’s L1, will have its Dencun upgrade in this year’s first quarter, Uniswap then announced that their latest iteration of the protocol would be launched sometime in Q3 2024.

Now that the launch of Dencun on Mainnet has been scheduled for March 2024, we’re excited to provide an update to the community!

Uniswap v4’s launch is tentatively set for Q3 2024.

From community-built Hooks (https://t.co/WyaGr1Ti1t), to events, to Twitter Spaces, the…

— Uniswap Foundation (@UniswapFND) February 15, 2024

In essence, Uniswap v4 is a more efficient and cost-effective brother of v3. According to Uniswap’s own website, it is a “non-custodial, non-upgradeable, and permissionless automated market maker protocol.”

In the announcement, v4 is currently in its first phase with the developers finalizing the core functionalities and features of the upgrade. The update would let the team create new features on top of the current AMM design of the protocol. This eliminates the need for creating an entirely new design from the ground up.

Leading The Innovation Charge

Uniswap is also ramping up its effort in providing funding for innovators in the Web 3 space. Last week, the Uniswap Foundation X account released a detailed look at the organization’s new granting strategy.

Introducing our Reimagined Grants Strategy

Our vision is simple: to make the @Uniswap Protocol the liquidity layer of the Internet.

As stewards of the Protocol and the Community, we have evolved our grants strategy to turn this vision into reality.

Here’s why and how

— Uniswap Foundation (@UniswapFND) February 7, 2024

In short, the new strategy revolves around granting a minimum of $ 250,000 in four audience-specific categories: developers, researchers, delegates, and innovation (all stakeholders).

For now, no date of implementation has been announced for these new grants.

UNI: Challenging Week Ahead For Investors

The lead-up to the month of March has certainly brought a level of hype around the broader market, but thus hype has since died down and was replaced by profit-taking attitudes. UNI will inevitably experience this bearishness taking hold in the coming weeks as the market potentially dips.

If this happens, investors and traders have strong support on the 50% and 38.20% price levels. These supports will slow down any bearish advance, stabilizing UNI’s price at the $ 7.3 and $ 7 range.

Featured image from Adobe Stock, chart from TradingView

Binance Stirs The Waters With A 200 Million XRP Transfer – What’s The Plan?

Cryptocurrency exchange giant Binance made a bit of a headline by transferring a substantial amount of XRP tokens—200 million to be exact. The massive amount of the transfer has made nearly everyone in the crypto community come up with guesses as XRP tallied notable 4% increase in value following the transfer, which added an extra layer of intrigue to the situation.

The recent struggles of XRP, reflected in its monthly losses and declining network fundamentals, have created an air of uncertainty around the coin. Santiment data analyzed by NewsBTC indicates a steady drop in daily active addresses and a decrease in the rate of new address creation over the past month. Additionally, XRP’s supply in profit has seen a sharp decline since the beginning of the year.

Whale Alert Detects Binance XRP Movement

Investors’ pessimism about the payment-linked cryptocurrency has been further accentuated by the lack of profitability, evident in the consistently negative Weighted Sentiment for XRP in 2024. As the crypto market evolves, these factors contribute to the dynamic landscape and impact the sentiments of investors and market participants.

200,000,000 #XRP (105,914,024 USD) transferred from #Binance to unknown wallethttps://t.co/H8wJxoRtvA

— Whale Alert (@whale_alert) February 13, 2024

One platform that tracks high-value transactions, Whale Alert, made the flow of XRP tokens visible. At around 6:40 am UTC, Binance started three different transactions totaling 64.41 million XRPs. Trade observers took notice of the subsequent large transfer of 200 million XRP to a “unknown wallet.”

The 200 million token transfer represents almost $ 105 million at the current XRP selling price, highlighting the importance of this operation. After more research, we discovered that the beneficiary address of the $ 200 million transfer quickly transferred $ 4.28 million in XRP to a different address.

XRP Price Trades Higher After Binance Transfer

The real intent of these moves is still unknown at this point. But the cryptocurrency community has been quick to conjecture, with conversations centered on the potential for whale buildup. The transfers’ timing, which coincided with an increase in XRP’s price, has fueled conjecture even more.

With a respectable rise in value today, XRP, which had been in a protracted downturn, saw some hope. Notably, it traded at $ 0.53, increasing in value over the previous day and week to 0.6% and 4.1%, respectively, according to Coingecko data.

It’s possible that the enthusiasm surrounding XRP’s positive turnaround spurred major market participants—also known as “whales”—to take big action.

Related Reading: Solana Surges: Open Interest Hits $ 1.75 Billion, Price Up 8% Today

Featured image from Freepik, chart from TradingView

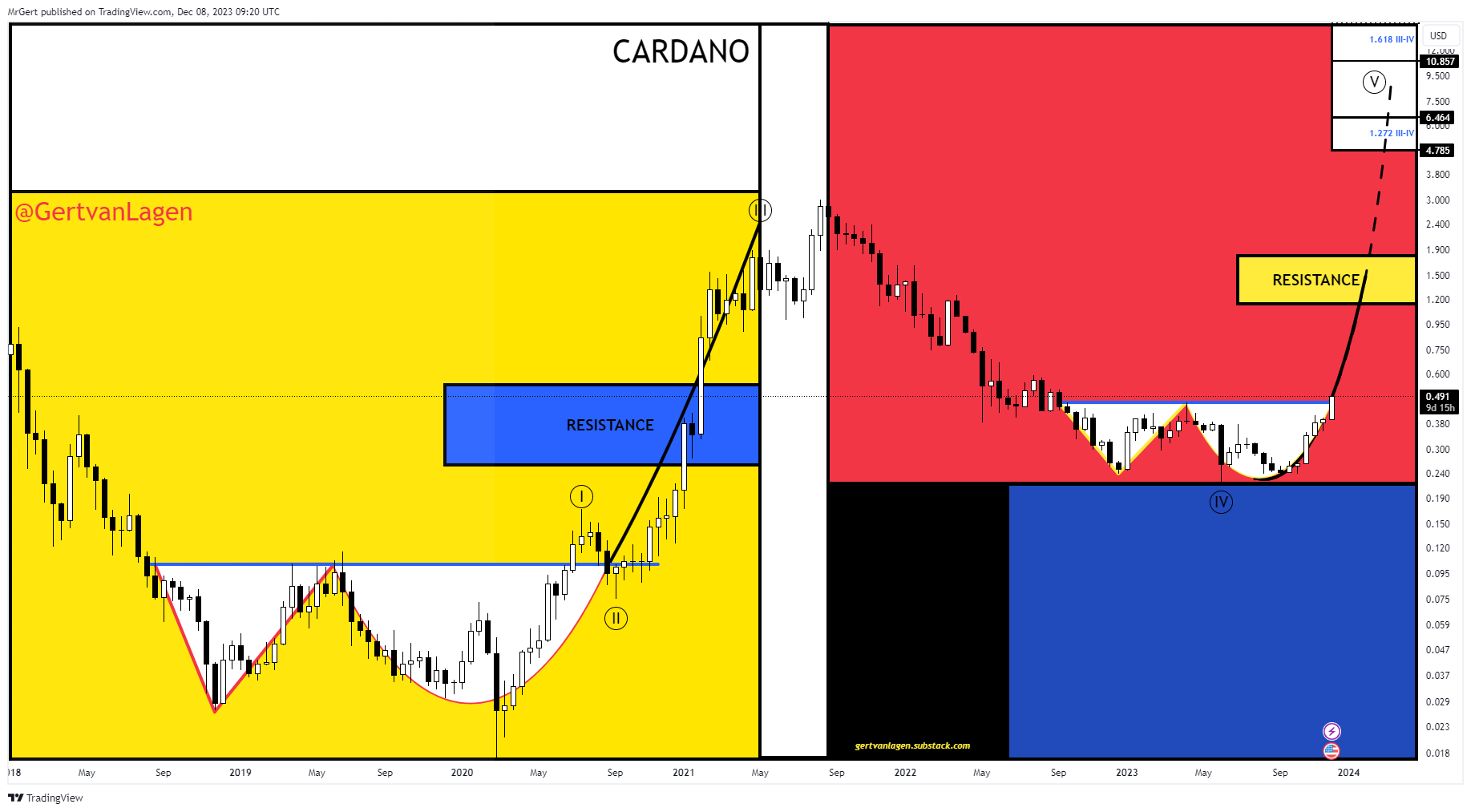

Top-Trader Picks Cardano As Bull Market Leader: Here’s Why

In a post on X (formerly Twitter), acclaimed crypto trader Gert van Lagen has pinpointed Cardano (ADA) as the potential frontrunner of the ongoing bull market. His analysis leans heavily on Cardano’s foundational strengths compared to its rivals, Ethereum (ETH) and Solana (SOL).

Why Cardano Is Van Lagen’s Top Pick

Central to van Lagen’s argument is the concept of decentralization, where he posits Cardano as a model of “fundamental superiority.” He articulates, “Cardano stands out for its fundamental superiority over Ethereum and Solana, boasting greater decentralization and the notable absence of support from centralized entities like Gemini.”

This statement not only underscores Cardano’s commitment to decentralization but also implicitly critiques the reliance of other blockchains on centralized support, suggesting a purer adherence to blockchain’s original ethos by Cardano.

Highlighting the critical importance of network reliability, van Lagen points to Solana’s vulnerability, marked by its “sporadic inexplicable network outages of a few hours.” He contrasts this with the inherent stability of the Cardano network, which he notes is “mathematically embedded in the Cardano ecosystem,” suggesting a foundation built on rigorous scientific principles and peer-reviewed research that underpins Cardano’s operations, enhancing its reliability and user trust.

Van Lagen’s enthusiasm extends to Cardano’s Extended Unspent Transaction Output (EUTXO) model, which he believes is a game-changer for blockchain scalability and efficiency. He explains, “In this bullish market, my top bet is on Cardano, leveraging its EUTXO model to dramatically scale network capacity through TPT, not just TPS.” This approach, focusing on Transactions Per Transaction (TPT) rather than just Transactions Per Second (TPS), allows for a more nuanced and complex handling of transactions, enabling a multitude of operations within a single transaction.

Roy M. Avila’s article, referenced by van Lagen, delves deeper into the TPT concept, illustrating how it differentiates from the traditional account model by allowing for a diverse array of transactions to be processed simultaneously within a single transaction. This significantly reduces the need for sequential transaction processing, enabling greater throughput and efficiency.

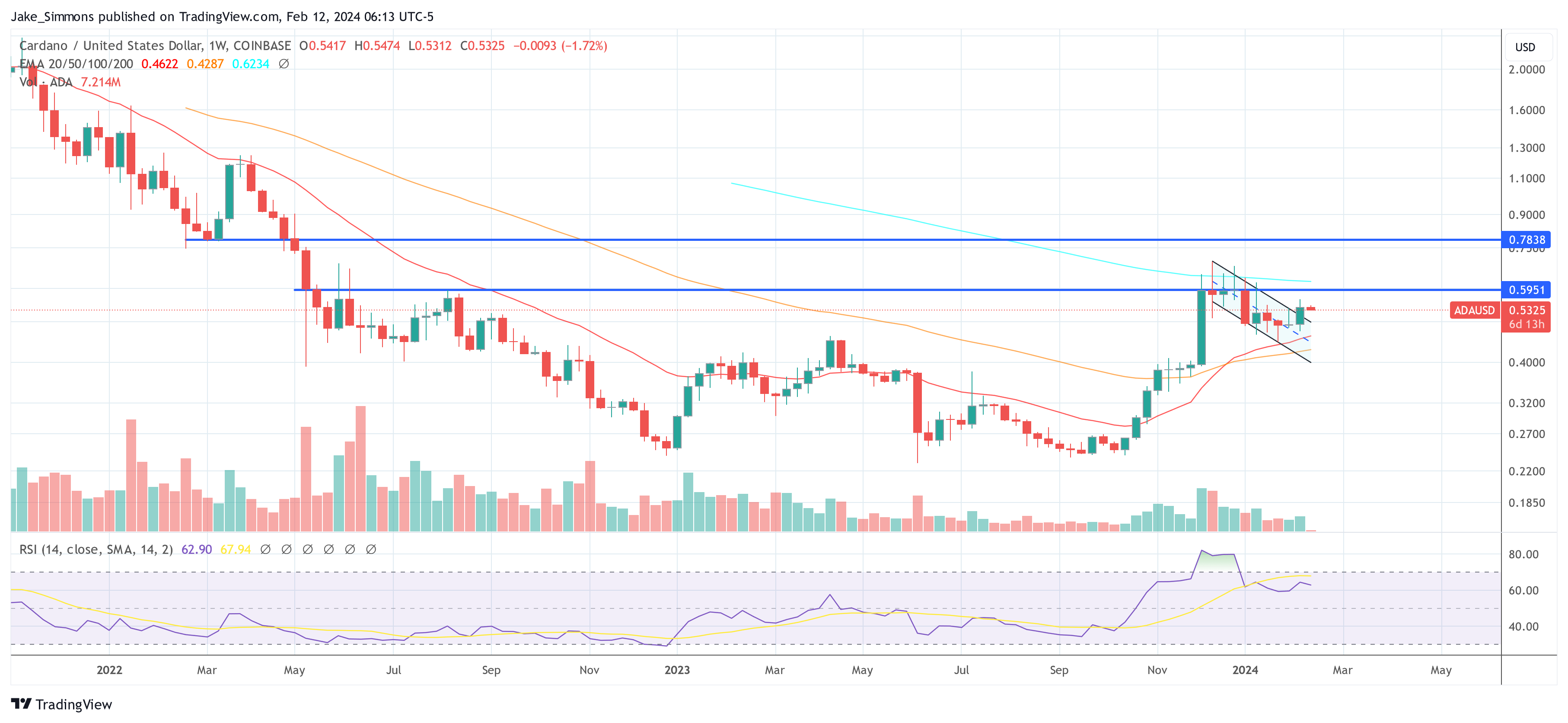

Technical Analysis For ADA

Van Lagen shares his technical analysis of Cardano, identifying key patterns and indicators that bolster his bullish stance. At the end of January, noted in a post on X, “Looks very much like ADA, broken black downtrend through weekly closes. Clear double bottom setup below red horizontal –> broken out, currently retesting.” This pattern suggests a strong reversal and potential for significant upward movement.

He further elaborates on ADA’s price action, observing, “ADA [2W] – Compare Adam and Eve bottoms within  &

&  . Price has broken through the blue neckline and is on its way to the key resistance zone before ATH: $ 1.2-1.8. Conservative extension targets: $ 5-15. Invalidation EW-count: $ 0.17.”

. Price has broken through the blue neckline and is on its way to the key resistance zone before ATH: $ 1.2-1.8. Conservative extension targets: $ 5-15. Invalidation EW-count: $ 0.17.”

These insights provide a detailed roadmap for ADA’s potential price trajectory, highlighting both the bullish outlook and critical thresholds for invalidation.

At press time, ADA traded at $ 0.5325.

Analyst Predicts Bitcoin Rally To $45,000 Before Pullback

Bitcoin (BTC) has started riding the recent bull market wave and rising with fresh gains after weeks of sluggish momentum, with crypto analysts predicting more potential gains for the leading cryptocurrency asset in the coming days.

Bitcoin To See A Correction After Surging To $ 45,000

A cryptocurrency expert from Cheeky Crypto has made a daring forecast for Bitcoin. The analyst revealed his recent projections during one of Cheeky Crypto’s latest episodes on YouTube.

His predictions came in light of the price of Bitcoin closing Wednesday on a positive note, leading the altcoin market as a whole with it. As the new trading day began, BTC’s price broke above the consolidation, signaling that bulls have returned to the fore.

Cheeky Crypto analyst’s latest analysis delves into the present trading range for Bitcoin. In the analysis, the expert talked about a potential surge to the upside that will take BTC to $ 45,000.

He defined the current stage as a continuation pattern and forecasted that after the range is done, there will be an upward breakout. The analyst mentioned that volume profiles have been declining throughout the market’s range, which gave him the belief that the price will increase to $ 45,000.

However, he believes a notable correction will occur after BTC reaches the aforementioned price level. Meanwhile, given the positioning on the Stochastic Relative Strength Index (RSI), he anticipates a further decline to $ 30,000.

He underscored that there is resistance at the 50 Exponential Moving Average (EMA) and support at the 50 Simple Moving Average (SMA) for BTC’s present trading range. If the 50 EMA is breached, Bitcoin may test the 50 EMA once again, and the 200 EMA would provide extra support.

Furthermore, the analyst looked at a series of indications throughout the hourly, daily, and weekly time periods. He noted key levels of support, resistance, and indicators to inspect for prospective market changes and momentum, like the RSI and the stochastic RSI.

BTC’s Price Surges Above $ 44,000, Eyes $ 45,000

Amid the recent bullish rally encompassing the crypto market, Bitcoin’s price has risen over $ 44,000. This marks the first time this month that the crypto asset has reached this level, suggesting market recovery.

The recent surge has sent quite a positive sentiment in the entire crypto space. It is believed that the rise might be due to the anticipation around the Ethereum Spot ETFs and BTC ETF options. Although, in comparison to last month, trend levels are still low, indicating that one should stay vigilant.

As of the time of writing, the price of Bitcoin has increased by over 4% in the past 24 hours, trading at $ 44,704. In addition, its market cap and trading volume have increased by over 4% and 47% in the past day.