SOL Price Faces Big Move – Can Bulls Send Solana To $120?

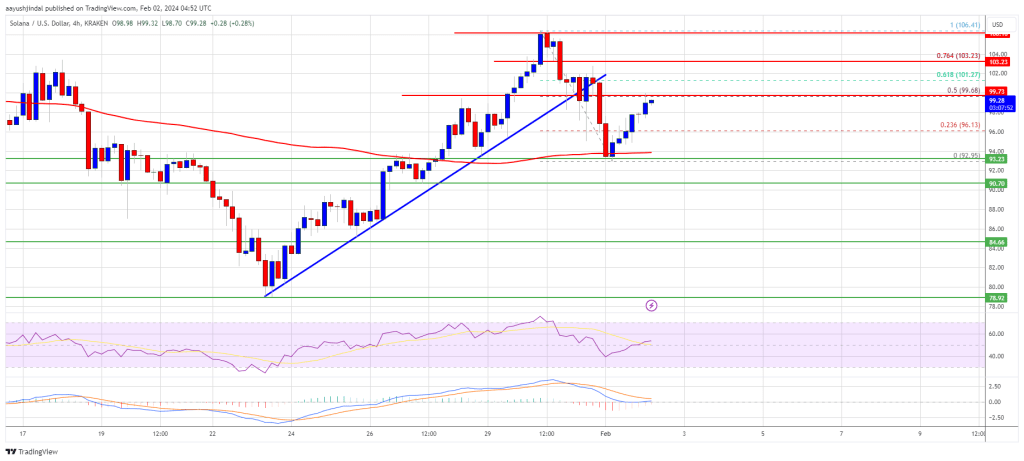

Solana is attempting a fresh increase from the $ 92 zone. SOL price could gain bullish momentum if it manages to clear the $ 100 and $ 104 resistance levels.

- SOL price started a fresh decline from the $ 106 resistance against the US Dollar.

- The price is now trading above $ 92 and the 100 simple moving average (4 hours).

- There was a break below a key bullish trend line with support at $ 100 on the 4-hour chart of the SOL/USD pair (data source from Kraken).

- The pair could start another increase if it surpasses the $ 100 and $ 104 levels.

Solana Price Faces Key Test

Solana price started a fresh decline after it struggled to clear the $ 106 level like Bitcoin at $ 43,800. There was a clear move below the $ 102 and $ 100 support levels.

Besides, there was a break below a key bullish trend line with support at $ 100 on the 4-hour chart of the SOL/USD pair. However, the bulls were active near the $ 92 level and the 100 simple moving average (4 hours). The price is now attempting a fresh increase above the $ 95 level.

The price retested the $ 100 zone and the 50% Fib retracement level of the downward move from the $ 106.41 swing high to the $ 92.95 low. SOL is now trading above $ 95 and the 100 simple moving average (4 hours).

Source: SOLUSD on TradingView.com

Immediate resistance is near the $ 100 level. The next major resistance is near the $ 104 level or the 76.4% Fib retracement level of the downward move from the $ 106.41 swing high to the $ 92.95 low. A successful close above the $ 104 resistance could set the pace for another major increase. The next key resistance is near $ 112. Any more gains might send the price toward the $ 120 level.

Another Decline in SOL?

If SOL fails to rally above the $ 100 resistance, it could start another decline. Initial support on the downside is near the $ 92 level and the 100 simple moving average (4 hours).

The first major support is near the $ 90 level, below which the price could test $ 85. If there is a close below the $ 85 support, the price could decline toward the $ 78 support in the near term.

Technical Indicators

4-Hours MACD – The MACD for SOL/USD is gaining pace in the bullish zone.

4-Hours RSI (Relative Strength Index) – The RSI for SOL/USD is above the 50 level.

Major Support Levels – $ 92, and $ 92.

Major Resistance Levels – $ 100, $ 104, and $ 112.

Binance Sets New Record: Spot Trading Volume Reaches $427 Billion

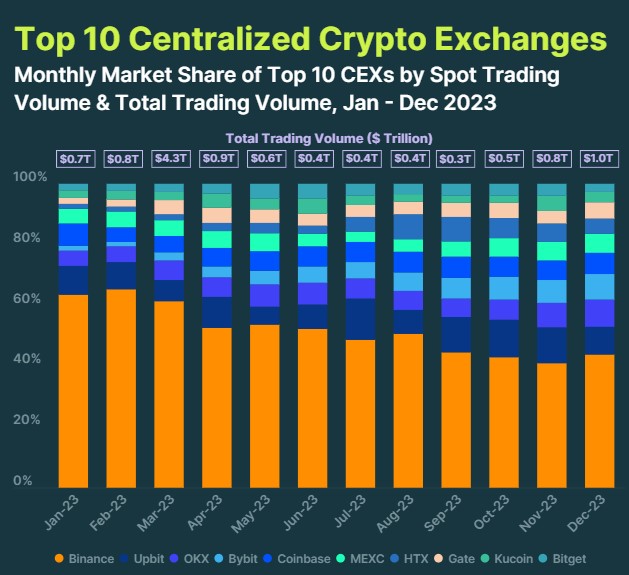

According to a recent CoinGecko report, Binance, the world’s largest centralized exchange (CEX) by trading volume, has retained its market leadership position in 2023.

Despite facing increased regulatory scrutiny and undergoing significant leadership changes, Binance maintained a market share of 43.7% and saw its spot trading volume rise to $ 427.1 billion in December 2023, representing a 37.5% month-on-month (MoM) increase.

Binance Trading Volume Reached $ 3.8 Trillion In 2023

According to CoinGecko’s report, Binance started the year with a commanding 63.5% market share but experienced a gradual decline throughout 2023, ending with a 43.7% market share in December.

While Binance still dominated the market with 52.6% of the total spot trading volume in 2023, the exchange’s relative market share decline was notable. In absolute terms, Binance generated $ 3.8 trillion in trading volume throughout the year.

As previously reported, Binance faced significant regulatory pressure throughout 2023, culminating in a settlement agreement in November that required the exchange to pay a $ 4.3 billion fine to the Department of Justice (DOJ) and the Commodity Futures Trading Commission (CTFC) for alleged financial breaches.

As part of the settlement, Binance’s CEO, Changpeng Zhao (CZ), also agreed to step down. Richard Teng has assumed the role of the company’s head, while CZ remains restricted from traveling outside the jurisdiction of the United States as the legal battle unfolds.

Upbit And OKX Follow Closely

Upbit, South Korea’s largest cryptocurrency exchange, managed to maintain its position as the second-largest centralized exchange in 2023, with a 9.5% market share and $ 687.0 billion in spot trading volume for the year.

According to the report, Upbit benefited from the Kimchi Premium, which resulted in strong local demand and premium prices for crypto assets.

The exchange’s monthly spot trading volume hit a yearly high of $ 90.7 billion in December, with a 93.5% quarter-on-quarter (QoQ) increase.

Conversely, OKX secured the third position among centralized exchanges in 2023, with a 6.7% market share and $ 485.9 billion in trading volume. Throughout the year, OKX experienced a steady increase in market share, starting at 5.1% in January and ending at 8.9% in December. The exchange’s trading volume in Q4 reached $ 177.9 billion, reflecting a notable 151.6% QoQ gain.

Among the top 10 centralized exchanges, CoinGecko reports that MEXC recorded the highest growth in Q4 2023, with trading volume surging by 203.7% to $ 90.4 billion.

Bybit followed closely with a growth rate of 162.1% ($ 107.5 billion), while KuCoin experienced a growth rate of 161.2% ($ 49.2 billion). KuCoin regained its spot in the Top 10 in Q4 after briefly losing it in Q3, with a market share of 3.3% at the end of December.

Binance Coin (BNB) has successfully maintained its position above the $ 300 threshold, with the current trading price standing at $ 304. This represents a 1.8% decrease in price over the past 24 hours.

Featured image from Shutterstock, chart from TradingView.com

XRP Price Will See 1,000% Rally When ‘Black Cloud’ Dissolves, What This Means

The host of the ‘Discover Crypto’ YouTube channel has boldly claimed that the XRP price could surge by 1000% from its current price range. He highlighted the Securities and Exchange Commission’s (SEC) case against Ripple as one of the factors that could spark this price surge.

XRP Price Could Do A 10X When Ripple And SEC Settle

In a video posted on the YouTube channel, the analyst suggested that XRP would rise significantly once Ripple and the SEC finally settled. He described this long-running legal battle between both parties as a “black cloud” that has continued to cause uncertainty in the XRP market.

He further noted how investors strongly dislike uncertainty, which could explain why they have continued to trade with caution rather than doubling down on their XRP investments. Meanwhile, the ‘Discover Crypto’ host believes that irrespective of how much Ripple ends up being fined, a settlement will no doubt be ‘positive news’ and the trigger for the price surge.

The crypto analyst went on to break down four other reasons why he believes that XRP’s price could surge by 1000%. First, he stated that a Ripple Initial Public Offering (IPO) could also trigger a significant rally for XRP. This price pump, he claims, will be facilitated by market makers and whales who would want to create a positive sentiment around the IPO launch.

To back up this point, he alleged that the biggest move for Bitcoin in 2021 wasn’t as a result of Bitcoin Halving or any market cycle but because of the Coinbase IPO. These same market makers are said to have pumped the flagship crypto’s price then.

Other Factors That Could Spark XRP’s Parabolic Move

The crypto analyst outlined crypto legislation as the third reason why XRP could rise exponentially from its current price levels. While admitting that the entire crypto market will benefit from this, he expects XRP to be one of the tokens that enjoy the most gains from this development.

Institutional adoption is also predicted to be another catalyst in XRP’s parabolic move. The ‘Discover Crypto’ host noted how the Spot Bitcoin ETFs have opened the doors to mainstream adoption. As such, he expects that more entities will want to add crypto tokens like XRP to their portfolio alongside their Bitcoin exposure.

The fifth factor that could spark the 1000% rally for XRP is the Bitcoin Halving. The crypto analyst predicts that all crypto tokens, including XRP, are going to pump post-halving. As such, he believes that buying XRP at $ 0.50 now is definitely a steal.

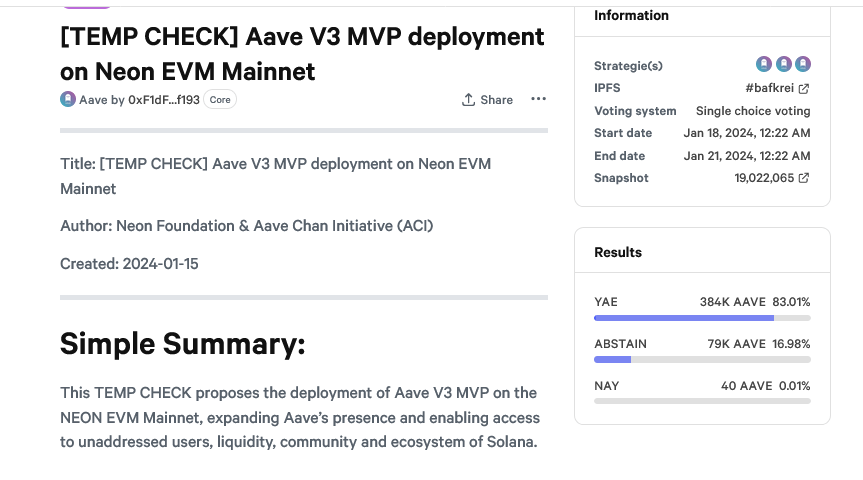

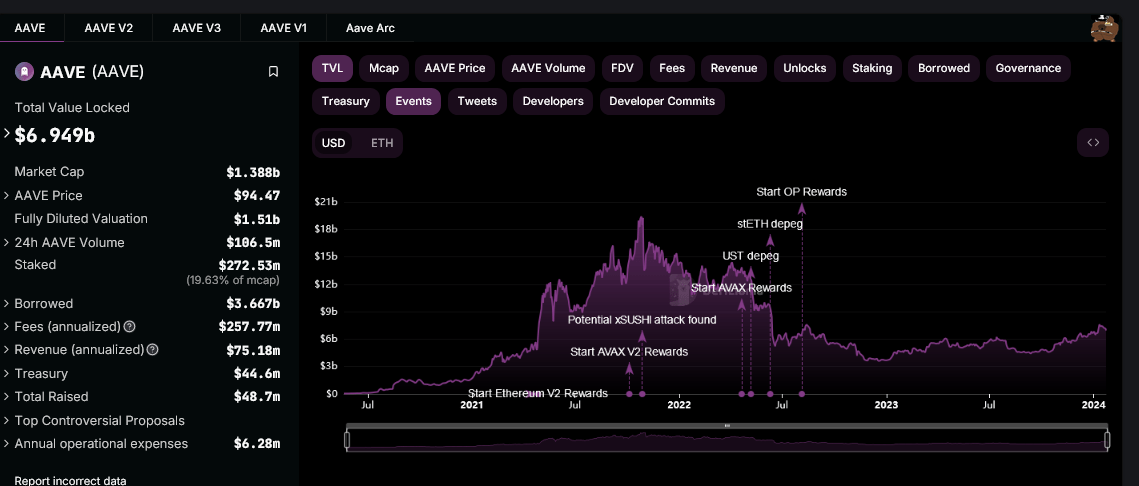

Aave V3 Ready For Solana After This Crucial Vote Passed

The Aave community has overwhelmingly approved a proposal that will set the ball rolling for deploying Aave V3 on Solana, a smart contracts platform. The motion, put forward by the Neon Foundation and the Aave Chan Initiative (ACI), passed with a majority vote of 83% based on results posted on January 21.

Solana Fast Rising, DeFi Ecosystem Active

Solana has been rapidly expanding, with its native currency, SOL, emerging as one of the top performers in 2023. To put it in perspective, SOL prices exploded from about $ 10 in 2023 to around $ 125 by the end of the year.

This surge saw SOL reverse losses of November 2022 while concurrently catalyzing events on the blockchain, spurring various activities, including the expansion of decentralized finance (DeFi), non-fungible token (NFT), and meme coin activities.

Related Reading: Bitcoin Price Turns Red, Why BTC Could Tumble Below $ 40K

On the other hand, Aave has been expanding to multiple Ethereum Virtual Machine (EVM) compatible networks, emerging as one of the leading decentralized finance (DeFi) protocols. According to on-chain data from DeFiLlama on January 22, Aave manages over $ 6.9 billion worth of assets across ten chains. A big chunk, over 90%, comprises assets on Ethereum. Aave v3 has a total value locked (TVL) of $ 4.9 billion.

Aave V3 On Solana, What It Means

The TEMP CHECK proposers are keen on Aave v3 deploying on Solana, considering the blockchain’s rapid growth in the past year. They observe that the blockchain’s DeFi TVL and broad user base would likely benefit the lending and borrowing protocol, cementing its position as a market leader.

If Aave is deployed on Solana, the protocol will access the deep liquidity on the blockchain. At the same time, users will access Aave services more conveniently. Subsequently, the proposers reiterated this move will cement Aave’s position as the leading liquidity market on-chain. Moreover, it will likely open up new opportunities for collaboration between the Aave, Solana, and other Neon EVM communities.

Neon EVM is a cross-chain bridge for users to transfer assets between Ethereum and other blockchains. Through this bridge, Aave v3 will go live on Solana without any major reconfiguration of the protocol’s codebase. Among the tokens that will be initially supported is SOL. Users will be free to borrow USDC, a stablecoin.

The passing of the TEMP CHECK also reflects Aave’s ambition to expand across multiple blockchains beyond EVM networks. So far, Aave has been deployed on various platforms, including layer-2s like Arbitrum and Base, Avalanche, and Ethereum’s sidechain, Polygon.

Crypto Analyst Predicts XRP Price Will Surge 800% To Reach $5 In The Next 90 Days

Crypto analyst Egrag Crypto recently made a bold prediction as to the future trajectory of the XRP price and asserted when exactly the crypto token will hit this price level. Considering XRP’s current price level, it will no doubt be interesting to see how this prediction plays out.

“XRP To $ 5 In 90 Days”

Egrag mentioned in an X (formerly Twitter) post that XRP will rise to $ 5 in 90 days. The analyst also suggested that this price surge was just the beginning of XRP’s meteoric rise, as he said that the $ 5 range will mark the “initial wave 1 of a prolonged bull market.” This bull market, he expects, will span for several months, possibly enough time for XRP to hit all of Egrag’s bullish targets.

The analyst outlined these bullish targets in a subsequent post as he noted that they remain unchanged. Egrag predicts that XRP will hit $ 1.2, $ 1.6, $ 7.5, and $ 13 on its way to $ 27. He had previously laid out a narrative as to why XRP will surge by over 4000% to hit $ 27. According to him, XRP hitting this price level was a real possibility considering that the token had in 2017 risen by 61,000%.

Egrag happens to be one of the analysts who are most bullish on XRP’s future despite its current price action. His most bullish prediction to date remains how XRP could rise to $ 2,500 by 2029. All this while, he has also urged XRP holders to be more patient as good things lie ahead for those who will stick around.

Notably, Egrag credits his conviction to the amount of research he has put into studying XRP’s price movement over the years. Another reason why he seems to have become more bullish on XRP is because of the regulatory clarity that it enjoys. He once noted that this places XRP as the “safest investment choice.”

A Further Analysis Of XRP Price Chart

In the meantime, Egrag believes that the $ 0.55 level stands as “significant support for XRP,” and he doesn’t see the weekly candle closing below the $ 0.50 level. He further noted that the “edge of the atlas line looms at $ 0.43.” However, he is not anticipating XRP dropping to that price level. Instead, he is choosing to focus on the bigger picture.

Meanwhile, crypto analyst Crypto Rover also recently predicted that a parabolic breakout is on the horizon for XRP. Just like Egrag, he provided a timeline, saying it would happen in the “upcoming 8 weeks.” However, His prediction looks more conservative than Egrag’s $ 5 prediction, as the chart Rover shared showed that XRP could rise to just over $ 1.

At the time of writing, XRP is trading at $ 0.57, according to data from CoinMarketCap.

How To Buy And Trade Tokens On The SEI Network

In the dynamic trading world where time is of the essence and you are looking for a combo of speed and low fees, the SEI Network is the fastest decentralized Cosmos-based L1 blockchain that is trading-based with the availability of decentralized exchanges (DExs).

The SEI Network has been optimized to handle large volumes of transactions quickly and efficiently while keeping costs low. This makes it an attractive option for businesses and individuals looking to exchange value in a fast, efficient, and cost-effective manner.

The network has an in-built order book that allows smart contracts to easily access shared liquidity. This shared liquidity feature makes it possible for smart contracts to interact with each other and exchange value without third-party interference.

The way SEI is structured makes it possible for decentralized exchanges and trading applications in areas such as DeFi, NFTs, and gaming to provide the best possible user experience.

In this easy-to-follow guide, we will explore the main features of the super-fast SEI Network, how to set up a trading account, and the different ways to obtain and trade the SEI token. By the end of this guide, you will have a good understanding of how the SEI Network works, its advantages, and how to get started.

Features of SEI Network

Speed:

The most unique feature of the SEI network is its speed. It is currently the fastest chain to finality, boasting an impressive lower bound of 300 milliseconds. With unparalleled speed and efficiency, SEI allows for transactions to be immutably recorded on the blockchain in record time using an on-chain order book.

It is superior in terms of finality and is indisputable. When using SEI, users experience the near-instantaneous confirmation of their transactions, providing a seamless and efficient blockchain experience.

The network’s ability to achieve finality rapidly sets it apart from other blockchain platforms, making it an attractive choice for those seeking very fast and secure transaction processing.

Frontrunning protection:

The SEI network provides robust frontrunning protection, effectively combating the malicious practices that plague most of the other ecosystems. With advanced algorithms and stringent safeguards, SEI ensures secure and fair transaction processing, free from manipulation and unfair advantages.

By prioritizing integrity and trust, SEI sets a high standard for ethical conduct and fosters a level playing field for all participants to engage and experience a secure and reliable platform where transactions are protected, and investments are safeguarded.

Twin Turbo Consensus:

One standout feature of the SEI network is the twin-turbo consensus. This innovative consensus mechanism harnesses the power of two turbocharged engines working in sync to allow SEI to achieve exceptional speed and throughput, surpassing industry standards.

SEI’s twin-turbo consensus is designed to handle a lot of transactions at once without slowing down or compromising reliability. It has the ability to adjust and allocate resources as needed when transaction volumes increase.

This means that the SEI network can keep up with growing demands and perform at its best without compromising speed or dependability. So no matter how many transactions are happening, SEI is able to ensure smooth and efficient processing all the way.

Native Matching Engine:

SEI’s native matching engine is a valuable asset for exchange teams, offering rapid order matching and execution capabilities. It empowers exchanges to handle high volumes of transactions efficiently, catering to active traders on the network.

The engine’s flexibility allows customization to meet specific trading requirements, ensuring a tailored and user-friendly experience. With strict enforcement of matching rules, it upholds transparency and fairness in the trading process. Exchange teams leveraging SEI’s native matching engine can optimize their operations, enhance user experiences, and build a trustworthy trading ecosystem.

SEI Network: The Layer 1 For Trading

Trading is undeniably the most widely adopted use case for cryptocurrencies. However, it is a common misconception among crypto enthusiasts that trading is solely limited to decentralized finance (DeFi) applications. In reality, the need to exchange digital assets is fundamental to every aspect of the crypto ecosystem, ranging from social applications to non-fungible tokens (NFTs) and gaming.

Recognizing the significance of trading across the crypto space, SEI Networks has developed a Layer 1 blockchain specifically tailored to meet the diverse trading needs of users. SEI’s primary objective is to provide a robust, scalable, and seamless trading experience. By optimizing every layer of the technology stack, SEI ensures that users can efficiently exchange digital assets across various sectors while maintaining reliability and scalability.

SEI Networks addresses the scalability challenges associated with trading by building the first Layer 1 blockchain specialized for trading. This approach enables SEI to offer the most efficient infrastructure for the exchange of digital assets.

By focusing on the unique requirements of trading, SEI Networks aims to enhance the overall trading experience for users and facilitate the seamless flow of digital assets across different applications and use cases.

With its emphasis on scalability, reliability, and user experience, SEI Networks is well-positioned to serve as a foundational blockchain platform for the trading of digital assets. Whether it’s DeFi protocols, NFT marketplaces, gaming platforms, or other crypto-based applications, SEI Networks provides a solid infrastructure to support the exchange of assets and foster the growth of the broader crypto ecosystem.

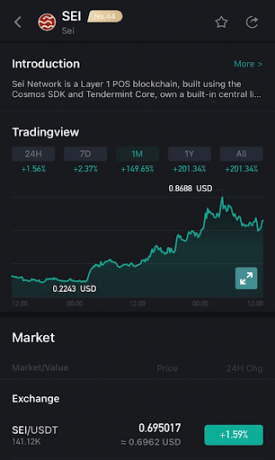

SEI Token

The rise in popularity of EVM-compliant blockchains and the parallelization process is driving the growth of the sei Network’s SEI token. SEI token serves as the native cryptocurrency within the SEI ecosystem, SEI token fulfills a variety of roles, which include:

- Transaction Fees: SEI token is utilized to cover transaction fees incurred on the Sei Network. These fees serve as incentives for validators and contribute to the network’s security.

- Staking: SEI tokens can be staked by users to accrue rewards and bolster the overall security of the SEI Network.

- Governance: SEI tokenholders possess the ability to actively participate in the governance of the SEI Network. This participation encompasses voting on proposals and the election of validators.

SEI token presents itself as a promising cryptocurrency with a diverse range of potential applications, positioning itself at the forefront of blockchain innovation tailored for trading purposes.

How To Configure Your Wallet To Begin Trading On The SEI Network

To trade tokens on the SEI Network, you would first need to connect your wallet to the SEI Network. Keplr is a popular browser extension wallet that can be used to interact with the SEI Network.

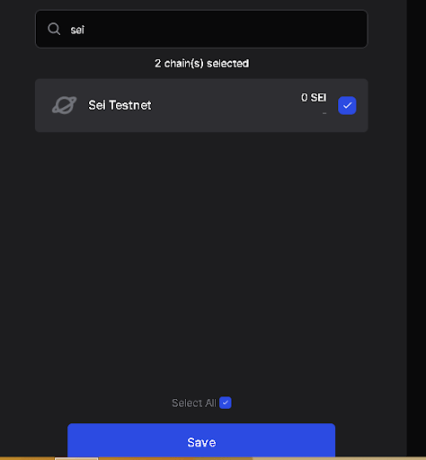

Ensure your Keplr wallet extension has been added to your browser as shown below:

Once connected to your Keplr wallet, go to Keplr using the extension on your Chrome browser, click on the hamburger sign in the top left corner, and select “Manage Chain Visibility”:

Click on the search bar, next type in SEI, Enable it, and Save it:

How To Buy And Trade SEI On Centralized Exchange Platforms

To embark on the journey of acquiring SEI, one can explore various prominent exchanges where SEI is listed. Platforms such as Binance, Kucoin, and COINEx offer a convenient gateway for purchasing SEI.

- Create or log in to an account with any of the exchanges listed above.

- Deposit Funds: After logging in, using the image below click on “deposit” to deposit funds into your account using any supported cryptocurrencies or deposit methods available on the exchange. Having funds in your account enables you to execute trades seamlessly.

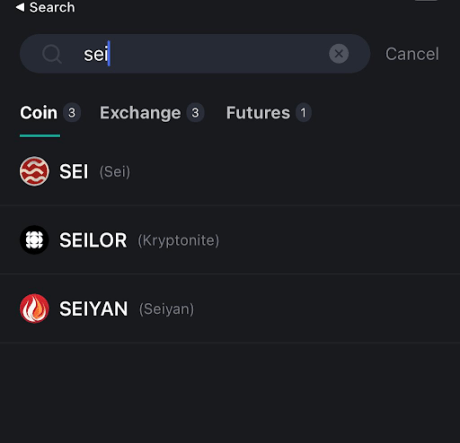

- Navigate to SEI Trading Page: Once your account is funded, go to the dedicated SEI trading page or type “sei” in the search bar for easy navigation. Here, you can find various trading pairs with SEI tokens.

- Choose a Trading Pair: Select the desired trading pair that matches SEI with another cryptocurrency. For instance, you may choose SEI/USDT if you wish to trade SEI against USDT (Tether).

- Specify the Purchase Amount: Determine the quantity of SEI tokens you want to purchase. Input the amount in the trading interface, which will calculate the corresponding cost based on the current market price.

- Execute the Trade: With the specified amount, proceed to execute the trade. Confirm the details, and if you are satisfied, submit the order. By following these comprehensive steps, you can easily trade SEI on CoinEx, taking advantage of the available trading pairs.

Related Reading: Celestia Network: How To Stake TIA And Position For 5-Figure Airdrops

Once you’re done, go to your Keplr wallet, click on Deposit, and copy your SEI wallet. Then go over to your centralized exchange account, click on Withdraw, and then send your SEI tokens to your Keplr wallet address you copied earlier. (Always double-check to make sure you have the correct wallet address).

The SEI network is quite fast so the tokens should arrive in your Keplr wallet in a matter of minutes. As soon as the SEI tokens arrive in your wallet, you’re ready to start trading tokens on the network.

How To Trade Tokens On SEI Network Using Keplr Wallet

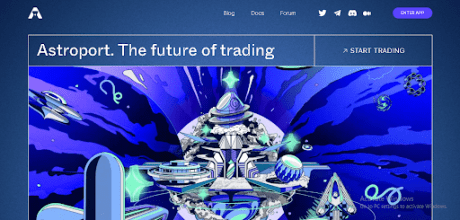

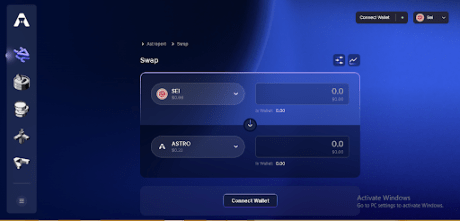

To start trading on the SEI network, navigate to the Astroport decentralized exchange (DEX). Visit the site’s homepage and click on “Start Trading” as indicated in the top right corner in the image below:

The next step is selecting the SEI Network and clicking on the “Connect Wallet” option on Astroport at the top right corner as illustrated below:

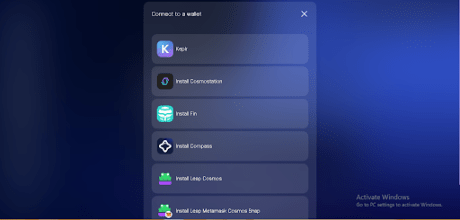

Connect to your preferred wallet, in this case, it’s Keplr wallet:

Once connected and the SEI network is enabled you can now trade on the SEI network by navigating to the DEX (decentralized exchange) in this case using Astroport and selecting the token pair you wish to trade.

You can search for the token you want to trade using the name or the contract address obtained from the project’s website or official social media handles. Select the amount of SEI tokens you want to convert to the new token and click “Swap.”

Once the transaction has been confirmed, your tokens will be transferred to your connected (Keplr) wallet. Rinse and repeat to buy and sell tokens on the SEI network.

Tracking SEI Token Charts

Users can also utilize Coinhall to check charts, providing valuable market insights. Coinhall offers two distinct advantages: comprehensive charting tools that provide in-depth market analysis, and real-time access to valuable insights for making informed trading decisions.

Conclusion

SEI network offers a fast, efficient, and cost-effective platform for buying and trading tokens. With its optimized infrastructure, SEI can handle large transaction volumes quickly and at low fees. It is the first sector-specific Layer 1 blockchain, specialized for trading to give exchanges an unfair advantage.

The SEI token has been able to maintain strong investor support on their platforms including a seven-day rally leading to over 43% surge. The network’s features, such as its speed, frontrunning protection, twin-turbo consensus mechanism, and native matching engine, make it an attractive choice for trading enthusiasts.

SEI’s native cryptocurrency, SEI token, serves various purposes within the ecosystem, including covering transaction fees, staking for rewards, and participating in governance.

Here Are The Reasons Bitcoin Price Could Drop To $37,000 Before The Halving

The price of Bitcoin has been on a massive bullish momentum since the approval and launch of Spot Bitcoin ETFs. However, a crypto analyst, Jason Pizzino, predicts a temporary halt in the growing trajectory, citing Bitcoin’s proximity to a crucial resistance point that could result in a significant price drop.

Analyst Foresees Bitcoin Price Correction

In a recent YouTube video published on Friday, January 12, Pizzino shared his insights into the current market conditions of Bitcoin, the world’s largest cryptocurrency. According to the analyst, the price of the top crypto is expected to drop by 20% to 22%, reaching possible support levels of $ 37,000 to $ 39,000 before the Bitcoin halving.

The halving which is expected to take place in April 2024 is an event that would see Bitcoin mining rewards cut by half to reduce the number of new coins entering the market. This reduction effectively decreases the cryptocurrency’s total supply and supposedly increases its value through scarcity.

Pizzino substantiated his predictions by pointing out that BTC is currently trading at a key resistance level in the bull market that could result in a significant price correction. He acknowledged that the excitement surrounding Spot Bitcoin ETFs has successfully pushed the cryptocurrency to its recent highs. However, the crypto analyst also highlighted a possibility of complacency following the present hype which could lead to a major price correction.

While the crypto has experienced an impressive uptrend in recent months, Pizzino emphasized the significance of understanding historical price patterns and market behaviors. He stressed the importance of being prepared for any potential correction or retracement in the price of Bitcoin.

BTC Plunges Below $ 42,000

Following the official approval of Spot Bitcoin ETFs by the United States Securities and Exchange Commission (SEC), the price of Bitcoin has been skyrocketing. The cryptocurrency surged to $ 49,000 on Thursday, January 11, after Spot Bitcoin ETFs had launched and investors had started trading officially.

However, Bitcoin’s price experienced a massive downturn recently after news of Vanguard restricting its customers from trading Spot Bitcoin ETFs on its platform spread. As a result, the cryptocurrency experienced a price drop below $ 42,000, falling more than $ 7000 short of its 2024 peak of $ 49,000.

Presently, the coin has recouped some of its lost gains and at the time of writing it’s current trading price is at $ 43,158.52 according to CoinMarketCap. While the dip is perceived as a temporary setback for the crypto market, it is also regarded as an opportunity to enter the market at more affordable price levels.

Featured image from Shutterstock

Bitcoin Erases $49,000 ETF Rally As Coinbase Users Take To Selling

Bitcoin had earlier shown a sharp rally toward the $ 49,000 mark, but the asset was quick to retrace the entire surge as the Coinbase Premium turned negative.

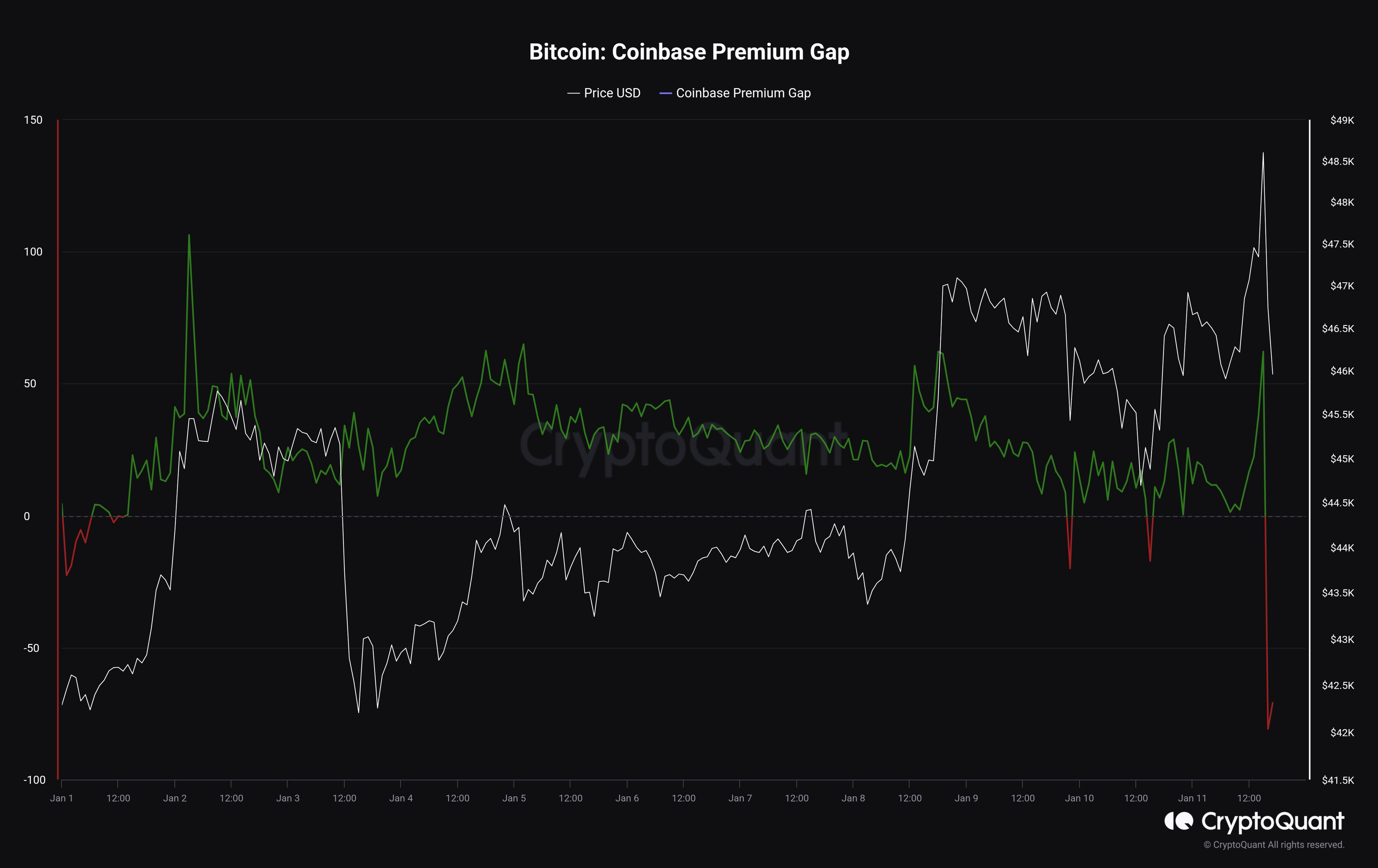

Bitcoin Coinbase Premium Gap Plunged Into Negative During Past Day

As pointed out by CryptoQuant Netherlands community manager Maartunn in a post on X, the Coinbase Premium Gap has now turned notably negative after being mostly positive for the last few days.

The “Coinbase Premium Gap” refers to the difference between the Bitcoin prices listed on the cryptocurrency exchanges Coinbase (USD pair) and Binance (USDT pair).

This indicator’s value basically provides hints about how the buying or selling behaviors on these two largest platforms in the sector differ from each other right now.

When the metric has a positive value, it means that the price listed on Coinbase is higher than on Binance currently. Such a trend implies the former platform’s users are participating in a higher amount of buying (or lower amount of selling) than the Binance users.

On the other hand, the indicator being positive suggests that Binance might be observing a higher degree of buying pressure at the moment as the price listed on the exchange is greater.

Now, here is a chart that shows the trend in the Bitcoin Coinbase Premium Gap since the start of the year:

As displayed in the above graph, the Bitcoin Coinbase Premium Gap has observed a sharp plunge down into the negative territory during the past day or so. Before this plummet, the indicator had been mostly at positive values since the start of the year.

There were a few dips into the red zone earlier as well, but the indicator only attained minor negative values during these drops. This time, though, the premium is down to significantly negative levels.

The price surges this year were being driven by the buyers on Coinbase, as the price rose every time the premium did as well. Coinbase is popularly known to be used by US institutional investors, so the green premium suggested that these large entities were buying, most likely in anticipation of the ETFs, which finally gained approval on January 10th.

A while after this approval, BTC went on to sharply rally toward the $ 49,000 level, but the asset’s run was very short-lived as its price plummeted hard back towards the price prior to the move, thus erasing all the gains.

The Coinbase Premium Gap had been notably positive alongside the surge, but the indicator then showed its plunge into the negative territory alongside this quick retrace. It would appear that some American institutional traders may have used the opportunity to harvest their profits.

BTC Price

Bitcoin has been moving sideways since the quick rally and drawdown, as its price is still floating around the $ 45,800 level.

Analyst Predicts $570 Billion Inflow Amid Bitcoin Spot ETF Approval

Scott Melker, a cryptocurrency analyst and advocate has pointed out a massive inflow into Bitcoin following the approval of BTC Spot Exchange-Traded Fund (ETF).

Bitcoin Might Be Poised For $ 570 Million Inflow

The crypto analyst shared his projections with the entire cryptocurrency community on the social media platform X (formerly Twitter). Melker proposed that $ 570 billion could be invested in a Bitcoin ETF, representing just 0.5% of the overall assets managed by Registered Investment Advisors (RIAs).

In the X post, Melker pointed out that the overall assets managed by RIAs are currently valued at $ 114 trillion. He also highlighted that the total market capitalization of Bitcoin is currently pegged at $ 860 billion.

The post read:

RIAs manage $ 114 TRILLION in assets. If a measly half of a percent of that money eventually comes into a #Bitcoin ETF, that would be roughly 570 billion dollars. The entire market cap of $ BTC now is $ 860 BILLION.

Several crypto analyst seems to disagree with Melker’s projections and have shared their opinions on his claims. One of the analysts who has voiced his opinions toward the prediction is top Bloomberg Intelligence analyst Eric Balchunas.

Eric Balchunas asserted that the RIAs assets valued at $ 114 trillion “seems really high.” He further added that the total advisor assets are worth around $ 30 trillion, due to data from market tracker Cerulli.

However, Melker backed up his claims by sharing a data screenshot from Thinkadvisor. Thinkadvisor highlighted that “15,114 fiduciary investment advisors currently manage $ 114 trillion in assets for 61.9 million clients.”

Another crypto enthusiast who has expressed displeasure with Melker’s inflow prediction is investment advisor Rick Ferri. The advisor challenged Melker noting that his “expectations are overblown.”

Ferri asserted that despite his 35 years of advisory experience, he still doesn’t understand why Melker would make such claims. Additionally, Ferri stressed that if any adviser decides to own BTC, they would have done so through Grayscale Bitcoin (BTC).

BTC Spot ETF To Serve As A Game-Changer For Crypto Market

Melker’s post came in response to Bruce Fenton’s post on how the Bitcoin Spot ETF could be a game-changer for crypto. Fenton predicted a dramatic change in the future while highlighting that several brokers, financial advisors, and RIAs are not knowledgeable about BTC.

According to the crypto investor, financial advisors must “keep up with what the public and customers are talking about.” Additionally, he noted that Bitcoin ought to be included in many portfolios, given its past 10 years of performance and correlation.

He also added that “financial advisors will follow the money and the trends.” Fenton asserted that advisors are not stupid about money and they will be motivated to learn.

Fenton went further to say that large investment firms would spend billions promoting to their clients Bitcoin-based investments. This would lead to chief economists talking about it, public awareness of its importance, and the creation of the best ads.