Why is Ether (ETH) price up today?

Ethereum’s price is stabilizing around $ 1,800, a psychological resistance level for months, amid growing ETF approval buzz.

Cathie Wood’s ARK sells Grayscale Bitcoin Trust shares as BTC hits $34K

The Grayscale Bitcoin Trust is the largest asset held by the ARK Next Generation Internet ETF, accounting for more than 10% of its portfolio.

MicroStrategy’s Bitcoin stash is back in profit with BTC price above $30K

The Michael Saylor-led software firm has made $ 132 million in unrealized profits from its Bitcoin bet.

Crypto advocates file amicus brief to address users’ Fourth Amendment privacy rights

The amicus brief was filed to support an appeal against the U.S. Internal Revenue Service in relation to a 2017 court order where Coinbase was forced to hand over data from more than 14,300 of its users.

Big Questions: What did Satoshi Nakamoto think about ZK-proofs?

What was once a passing interest of Bitcoin inventor Satoshi Nakamoto, zero-knowledge-proof technology is now a major part of the crypto world.

Coinbase selects Ireland as its European crypto hub

The crypto exchange has applied for a license under the EU’s new Markets in Crypto-Assets Regulation with the Central Bank of Ireland and, if successful, will be able to “passport” its services across EU states.

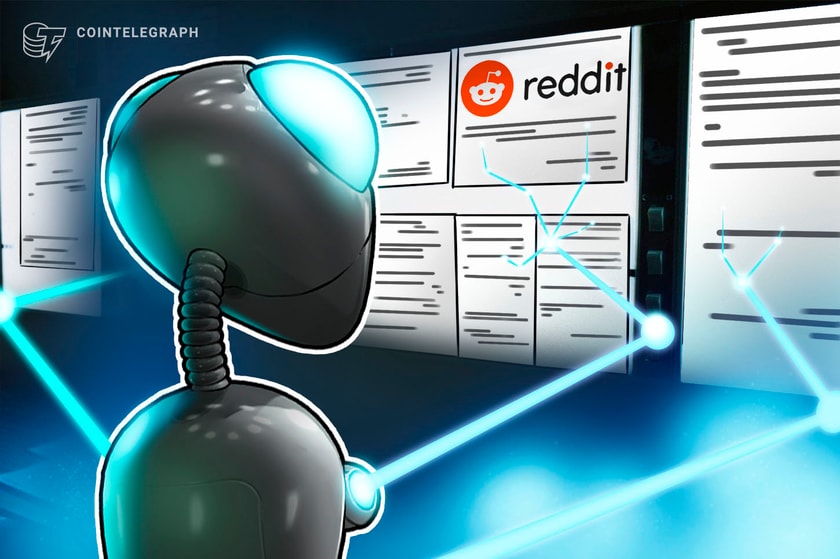

Reddit to wind down blockchain-based rewards service ‘Community Points’

Reddit will shutter its Community Points feature on Nov. 8, citing scalability issues.

Shiba Inu Shatters Resistance: A Sign Of A Bigger Reversal?

Shiba Inu (SHIB) has recently embarked on a surprising journey, defying the odds and setting the stage for a potential game-changing reversal.

A recent report unveils fascinating insights into SHIB’s price action, highlighting both optimism and caution in equal measure.

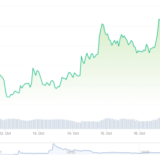

SHIB, currently priced at $ 0.00000705 according to CoinGecko, has exhibited remarkable resilience in the face of adversity. Over the past 24 hours, it faced a modest 0.9% decline, while the seven-day dip amounted to 1.6%. However, the most intriguing aspect of SHIB’s journey lies in its confrontation with a critical resistance level.

Recent market analysis reveals that SHIB is engaged in a fierce struggle with the 21-day Exponential Moving Average (EMA), a pivotal indicator for deciphering bullish or bearish trends in the world of cryptocurrencies. This battle has not gone unnoticed by traders, who are eagerly awaiting the outcome.

Bulls Vs. Bears: The SHIB Tug Of War

SHIB’s recent price action indicates a tug of war between bears and bulls, with the cryptocurrency precariously perched at a crucial resistance level. Should SHIB manage to conclusively close above this level, traders and investors could witness the resurgence of bullish momentum.

While SHIB enthusiasts are buoyed by the positive signs on the chart, there is one conspicuous element causing concern—the declining trading volume. A reliable rule of thumb in crypto markets is that a cryptocurrency battling significant resistance, like the 21-day EMA, should ideally be accompanied by surging trading volumes.

Increasing volumes signify robust buying interest and provide substantial validity to price movements. In the case of SHIB, the diminishing volume paints a contradictory picture. The declining interest from traders and investors raises questions about the sustainability of any potential bullish surge.

What Lies Ahead For SHIB?

The Shiba Inu community eagerly watches as their beloved cryptocurrency navigates these challenging waters. The battle with resistance and the conundrum of decreasing trading volumes offer mixed signals, making it imperative for investors to exercise caution.

SHIB’s journey remains one of unpredictability and volatility. Only time will reveal whether the recent breakthrough will pave the way for a lasting bullish trend or if caution will be the name of the game. In the ever-changing world of cryptocurrencies, one thing is certain: Shiba Inu continues to be a captivating, enigmatic player in the digital asset landscape.

As the market closely monitors these developments, the importance of tracking both technical indicators and market sentiment becomes increasingly apparent for traders and investors alike.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Gfinity Esports

Crypto payment option for Honda cars only works via third-party platform

FCF Pay’s X account has been suspended amid circulating misreporting about its “partnership” with Honda, which has never happened.