Big Questions: What did Satoshi Nakamoto think about ZK-proofs?

What was once a passing interest of Bitcoin inventor Satoshi Nakamoto, zero-knowledge-proof technology is now a major part of the crypto world.

Coinbase selects Ireland as its European crypto hub

The crypto exchange has applied for a license under the EU’s new Markets in Crypto-Assets Regulation with the Central Bank of Ireland and, if successful, will be able to “passport” its services across EU states.

Reddit to wind down blockchain-based rewards service ‘Community Points’

Reddit will shutter its Community Points feature on Nov. 8, citing scalability issues.

Shiba Inu Shatters Resistance: A Sign Of A Bigger Reversal?

Shiba Inu (SHIB) has recently embarked on a surprising journey, defying the odds and setting the stage for a potential game-changing reversal.

A recent report unveils fascinating insights into SHIB’s price action, highlighting both optimism and caution in equal measure.

SHIB, currently priced at $ 0.00000705 according to CoinGecko, has exhibited remarkable resilience in the face of adversity. Over the past 24 hours, it faced a modest 0.9% decline, while the seven-day dip amounted to 1.6%. However, the most intriguing aspect of SHIB’s journey lies in its confrontation with a critical resistance level.

Recent market analysis reveals that SHIB is engaged in a fierce struggle with the 21-day Exponential Moving Average (EMA), a pivotal indicator for deciphering bullish or bearish trends in the world of cryptocurrencies. This battle has not gone unnoticed by traders, who are eagerly awaiting the outcome.

Bulls Vs. Bears: The SHIB Tug Of War

SHIB’s recent price action indicates a tug of war between bears and bulls, with the cryptocurrency precariously perched at a crucial resistance level. Should SHIB manage to conclusively close above this level, traders and investors could witness the resurgence of bullish momentum.

While SHIB enthusiasts are buoyed by the positive signs on the chart, there is one conspicuous element causing concern—the declining trading volume. A reliable rule of thumb in crypto markets is that a cryptocurrency battling significant resistance, like the 21-day EMA, should ideally be accompanied by surging trading volumes.

Increasing volumes signify robust buying interest and provide substantial validity to price movements. In the case of SHIB, the diminishing volume paints a contradictory picture. The declining interest from traders and investors raises questions about the sustainability of any potential bullish surge.

What Lies Ahead For SHIB?

The Shiba Inu community eagerly watches as their beloved cryptocurrency navigates these challenging waters. The battle with resistance and the conundrum of decreasing trading volumes offer mixed signals, making it imperative for investors to exercise caution.

SHIB’s journey remains one of unpredictability and volatility. Only time will reveal whether the recent breakthrough will pave the way for a lasting bullish trend or if caution will be the name of the game. In the ever-changing world of cryptocurrencies, one thing is certain: Shiba Inu continues to be a captivating, enigmatic player in the digital asset landscape.

As the market closely monitors these developments, the importance of tracking both technical indicators and market sentiment becomes increasingly apparent for traders and investors alike.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Gfinity Esports

Crypto payment option for Honda cars only works via third-party platform

FCF Pay’s X account has been suspended amid circulating misreporting about its “partnership” with Honda, which has never happened.

Caroline Ellison speaks on FTX-Binance war, SEC won’t appeal Grayscale BTC ETF: Hodler’s Digest, Oct. 8-14

Caroline Ellison testifies in Sam Bankman-Fried trial, reveals more on FTX-Binance war; SEC reportedly has no plans to appeal on Grayscale Bitcoin ETF case.

SEC reportedly won’t appeal court decision on Grayscale Bitcoin ETF

If true, the SEC will need to review and decide on Grayscale’s spot Bitcoin ETF application. If denied, Grayscale could appeal the decision.

What happens if SEC doesn’t appeal Grayscale spot Bitcoin ETF ruling?

The SEC must appeal Grayscale’s win in a D.C. Appeals Court on Oct. 13, or it will have to approve — or try to delay — the firm’s Bitcoin ETF bid.

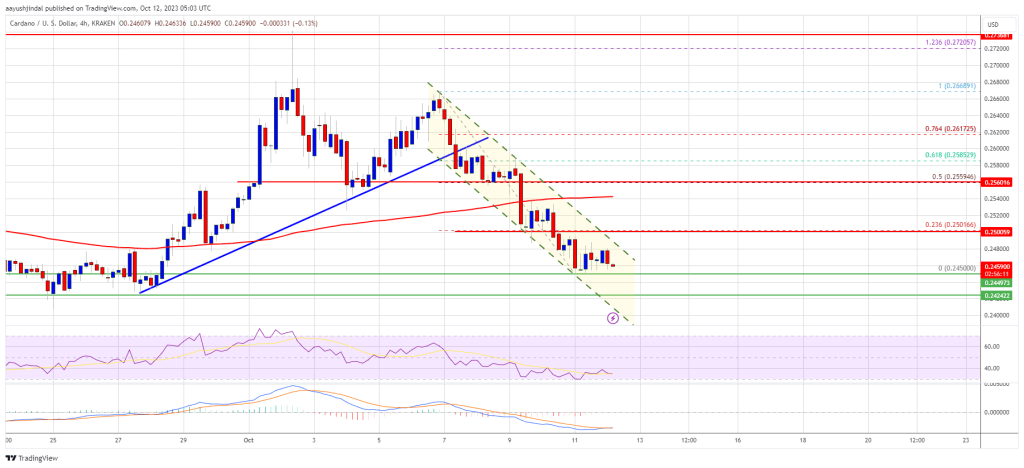

ADA Price Hints At Potential Correction, Buy The Dip?

Cardano’s price started a fresh decline below $ 0.250. ADA is testing important support at $ 0.2450 and might start a recovery wave.

- ADA price started a fresh decline below the $ 0.255 and $ 0.250 levels against the US dollar.

- The price is trading below $ 0.250 and the 100 simple moving average (4 hours).

- There is a key declining channel forming with resistance near $ 0.2480 on the 4-hour chart of the ADA/USD pair (data source from Kraken).

- The pair must stay above the $ 0.2420 support to start a fresh increase in the near term.

Cardano’s ADA Price Revisits Support

After a steady increase, Cardano failed to clear the $ 0.2650 resistance zone. The price formed a short-term top at $ 0.2668 and recently started a fresh decline, like Bitcoin and Ethereum.

There was a drop below the $ 0.255 support level. Besides, there was a break below a key bullish trend line with support near $ 0.259 on the 4-hour chart of the ADA/USD pair. The pair even declined below the $ 0.250 support and the 100 simple moving average (4 hours).

A low is formed near $ 0.2450 and the price is now consolidating losses. Cardano is now trading below $ 0.250 and the 100 simple moving average (4 hours). On the upside, immediate resistance is near the $ 0.248 zone.

There is also a key declining channel forming with resistance near $ 0.2480 on the 4-hour chart of the ADA/USD pair. The first resistance is near $ 0.250 or the 23.6% Fib retracement level of the downward move from the $ 0.2668 swing high to the $ 0.2450 low.

Source: ADAUSD on TradingView.com

The next key resistance might be $ 0.2560 and the 50% Fib retracement level of the downward move from the $ 0.2668 swing high to the $ 0.2450 low. If there is a close above the $ 0.256 resistance, the price could start a decent increase. In the stated case, the price could rise toward the $ 0.285 resistance zone.

More Losses in ADA?

If Cardano’s price fails to climb above the $ 0.250 resistance level, it could continue to move down. Immediate support on the downside is near the $ 0.245 level.

The next major support is near the $ 0.242 level. A downside break below the $ 0.242 level could open the doors for a sharp fresh decline toward $ 0.220. The next major support is near the $ 0.200 level.

Technical Indicators

4 hours MACD – The MACD for ADA/USD is losing momentum in the bearish zone.

4 hours RSI (Relative Strength Index) – The RSI for ADA/USD is now below the 50 level.

Major Support Levels – $ 0.245, $ 0.242, and $ 0.220.

Major Resistance Levels – $ 0.250, $ 0.255, and $ 0.285.

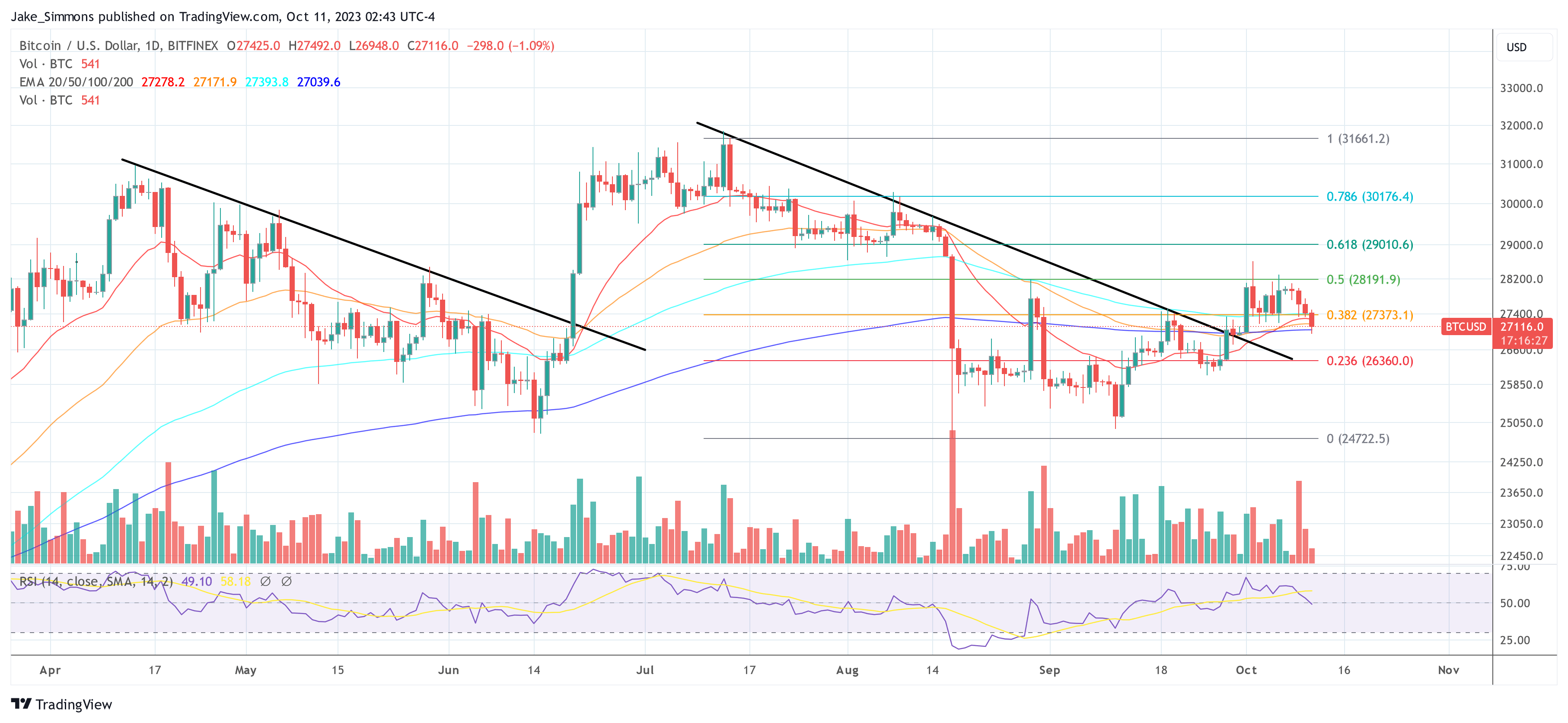

Legendary Investor Declares Now Is The Time To Buy Bitcoin: Here’s Why

In a recent interview with CNBC, billionaire hedge fund manager and legendary investor Paul Tudor Jones expounded on his bullish stance on Bitcoin amidst mounting global tensions and economic uncertainties.

Jones, an influential figure in the investment world, highlighted the current geopolitical environment as one of the most “threatening and challenging” he has ever witnessed and emphasized the importance of diversifying investment portfolios with assets like Bitcoin and gold.

Jones told CNBC, “I love gold and bitcoin together. I think they probably take on a larger percentage of your portfolio than they would [historically] because we’re going to go through both a challenging political time here in the United States and we’ve obviously got a geopolitical situation.”

Now Is The Time To Buy Bitcoin And Gold

Recent global events have exacerbated these sentiments. Over the weekend, the Israeli government launched a military response against Hamas following an attack on Israel, escalating tensions in an already fragile Middle Eastern region. Additionally, Russia’s recent invasion of Ukraine and growing discord between China and the US have further rattled global markets and economies.

In the same breath, Jones remarked on the US’s alarming fiscal position, stating it’s “probably in its weakest fiscal position since World War II.”

Responding to concerns about the potential impact of high interest rates on Bitcoin, Jones delved deeper into the dynamics of gold and market trades preceding a recession. He stipulated, “I think on a relative basis what’s happened to gold, it has been clearly suppressed. But you know that more likely or not we are going into a recession.”

Jones underscored a few hallmarks of recessionary trading environments, indicating, “There are some pretty clear recession trades. The easiest are: the yield curve gets very steep, home premium goes into the backend of the debt market and the 10-year, 30-year, 7-year paper, the stock market typically right before recession declines about 12%.” This decline, according to Jones, is not just plausible but likely to transpire at a certain juncture.

Additionally, he emphasized the prospective bullish market for assets like Bitcoin and gold during economic downturns, stating, “And when you look at the big shorts in gold, more likely or not in a recession, the market is typically very long; assets like Bitcoin and gold.”

Jones further prognosticated a substantial influx into the gold market, speculating, “So there’s probably $ 40 billion worth of buying coming in gold at some point before now and when that recession actually occurs.” Expressing his asset preference amidst the aforementioned conditions, Jones concisely noted, “So, I like Bitcoin and I like gold right now.”

Jones’s endorsement of Bitcoin isn’t new as the investor had previously championed the digital currency in several interviews, citing its potential as a hedge against inflation and lauding its immutable mathematical properties.

He once remarked, “Bitcoin is math, and math has been around for thousands of years.” By mid-2021, Jones even increased his Bitcoin allocation from 1-2%, labeling it as a “bet on certainty amid uncertain economic conditions.”

Jones’s remarks came at a time when the cryptocurrency saw an approximate 63% increase year to date, making it the best-performing asset in 2023.

At press time, Bitcoin was trading at $ 27,116, down roughly 2% over the past 24 hours. Amidst the recent price drop, BTC initially found support at the 200-day EMA (blue line), which the bulls should hold at all costs to avoid further downward momentum.